Ever since capitalism made its appearance in the late Middle Ages and came to dominate both production and politics in the late 18th century, there has been a vigorous debate on just what the nature of capitalism is. Central to these debates has been the question of capitalism’s relationship to the state, and particularly the question of whether capitalism was an enemy or a child of the state. There have been no shortage of great names in this debate: Smith, Marx, Mill, Mises and many other great minds weighed-in with weighty tomes on the topic. Yet I do believe that the honor of formulating the question in the most succinct and elegant terms possible must go to Sorin Cucerai in his brief but powerful essay, “The Fear of Capitalism and One of its Sources,” in the May issue of Idei in Dialog. [Note: the article is in Romanian, but for anyone who wants to read an English translation, please email me.] In but a few pages, and in a few powerful phrases, Mr. Cucerai captures the essence of capitalism and its relationship with the state.

Sorin’s arguments are directed primarily at the “anarcho-libertarians” who, like the Marxists, would have a “withering away of the state.” However, the historical reality is that under “conservative” regimes the state grows as fast—or even faster—than it does under liberal and social democratic regimes. Indeed, only the communists could grow the state faster than the conservatives, and they grew the state until it collapsed of its own weight, a feat which the conservatives in America are trying to duplicate, and may yet succeed Certainly something odd is going on here. An historical reality that pervasive and powerful cannot be overlooked or ignored I the name of ideology. However, it must be noted that in “defending” capitalism, Mr. Cucerai raises questions that challenge its very legitimacy. Indeed, Marx in his attacks on capitalism never said anything as negative about that system as Mr. Cucerai does in its “defense.”

It is important to understand Mr. Cucerai’s argument in its elegant simplicity. I summarize it as follows:

1. Men naturally seek direct access to the means of subsistence, usually in the form of their own land or tools.

2. This access makes a man less dependent on his neighbors and therefore less dependent on the markets.

3. But capitalism is the condition of dependence on the market for one’s very subsistence. Therefore, “the fundamental condition for the existence of a capitalist order is the absence of the individual autonomy in the sense of owing the source of your food,” and of forcing people to seek a monetary source of subsistence. This is not a natural condition, as is owning one’s own land, because “People do not search instinctively for a source of monetary revenue.” They do so only because they are forced to do so.

4. “Capitalism is made possible only if this natural process is interrupted by an instrument that makes sure nobody could have access to food and shelter unless a monetary revenue is used as an intermediary.”

5. “Therefore, the capitalist order is not natural. Such an order can be maintained only if there is an institutional arrangement which prevents the individual from not engaging in commercial relations through the agency of money.”

6. That “institutional arrangement” is a government that requires people to pay taxes and fees only in the form of money. Only the state can perform this coercive function upon which capitalism depends. “The source of the revenue gets prominence over the source of food; the commercial relations are widespread because, basically, it is impossible to avoid them.”

7. The state is necessary for another reason, namely that “free competition is as unnatural as capitalism itself.” In absence of the state, commerce would be a matter of rent-seeking, a behavior only government regulation can prevent.

8. Paradoxically, the “freedom and prosperity of capitalism” are possible only “by denying people direct access to food and shelter.” In order to have this capitalist “freedom,” we must be alienated from our own nature. But if this is done, then “he breech created between us and our nature- and between us and nature in general – open a space previously unknown to human freedom and it is a form of civilization.”

9. Because of this fundamental alienation from nature, “ any individual that lives in the capitalist order is a fundamentally precarious being, of a radical frailty. It is the precariousness of the one who has no firm ground under his feet.”

What is remarkable about this chain of reasoning is that it can be read as either an attack or a defense of capitalism. Indeed, it is difficult to discern, from within the argument itself, which way it will turn out. Mr. Cucerai offers only an instrumental defense of capitalism, namely that it will result in more goods and higher wages. Aside from the fact that such “consequentialism” is morally suspicious, at best, there is a question of whether the basis of comparison here is valid; one would have to compare the subsistence and security of a wage-based economy with that of a property-based economy, that is, of Mr. Cucerai’s “unnatural” economy with a more natural one. We know that in 16th century England, before capitalism came to dominate social relations, a common laborer could provision his family by 15 weeks of work, and a skilled laborer by 10. A century latter, after the closing of the commons and the seizure of the monasteries, which instantly converted England into a capitalist country, those numbers became 40 weeks and 32 weeks, respectively.1 Moreover, in a global economy, it is necessary, to weigh the wages of the workers in sweatshops before reaching a judgment on this question. Further, the plain fact of the matter is that nations which fed themselves comfortably for millennium before the coming of the capitalists find themselves starving under Mr. Cucerai’s “freedom.” But laying that question aside, we can address the strength of Mr. Cucerai’s arguments.

The first point is that this is very much an Aristotelian argument, even if it reaches conclusions opposite to Aristotle, in its division of economics into “natural” and “unnatural” exchanges. For Aristotle, natural exchange was that necessary to provision the household, while unnatural exchange had money alone for its object. The first sort of exchange was “natural” in the sense of having a natural limit. For example, a man buying bread for his family will buy what he needs and no more. But a man whose object is not bread but money might buy up every loaf of bread and every grain of wheat in order to corner the market and set the price to his own advantage. Since there is no limit to such exchanges, Aristotle regarded them are “unnatural.”

The second point we can note is how well the arguments accord with the actual history of capitalism. The plain historical fact is that capitalism and government grow hand in hand; the larger the business entities, the larger the government necessary to protect them. This fact had already been noted by Adam Smith in 1776, in The Wealth of Nations, three-fourths of which is devoted to documenting the incestuous relationship between big government and big business.

The third point is that Mr. Cucerai provides libertarianism with something it normally lacks, namely a theory of government. Hence the performance of government can be judged against that standard of its proper function. One may not agree with Mr. Cucerai’s definition of the function of government, but at least the standard is explicit; the question now comes under human intentionality and can therefore be controlled, at least in principle. For the anarcho-libertarians especially, government is despised in and of itself and hence every question of government becomes an “all-or-nothing” question. But framing the question in this way always works to the advantage of the “all” of the state, since in times of crises there are simply not enough nihilists to vote for the “nothing.” Thus, the increase of state power is always and everywhere the unintended consequence of libertarianism.

The fourth point is that Mr. Cucerai has accurately described the rule-bound nature of competition and exchange, and the fact that rules must be external to the market. Indeed, competition, properly understood, only works in a larger framework of cooperation, and this cooperation is expressed in agreement to rules which are imposed by institutions of common consent. Think about a football game. It is certainly a competition, and a violent one at that. Yet, it cannot take place without the framework of cooperation, namely, that all players will be bound by the rules and judged by referees who are not themselves players in the game. Unless the game stops when the referee throws the yellow flag, the game cannot really start. Without the referee, there can be no game, but only warfare, which will continue until one side is utterly defeated or even killed, at which point both the game and competition end.

The fifth point is that Mr. Cucerai has correctly identified monetization as foundational to capitalism. One historical confirmation of this point comes from the “hut tax” that the English imposed on their African colonies. The point of this tax was not revenue; indeed, it probably cost more to collect then it raised in income. Rather, its point was to force the Africans to get something they had never needed before: a job. The climate supported the people in relative comfort with relatively low levels of work, and the Africans, left to their own devices, were happy with this arrangement. But a money tax forced them to take employment in the English mines, plantations, and factories. The point of the hut tax was not revenue, but labor.

Finally, we can note that Mr. Cucerai has certainly given us an accurate description of capitalism, and all discussions of any system must begin with an accurate description. However, it is a description that leaves out one crucial element, an element that flows from the description but which Mr. Cucerai does not address. I will return to this point a little later.

All that being said, we still cannot determine whether capitalism under this description is a good or a bad thing. Indeed, do we really want a system that alienates man from his own nature and results in a “radical frailty,” a social arrangement in which we have “no firm ground under our feet”? There is a bleak, Orwellian character to Mr. Cucerai’s description in which “freedom is slavery,” in which man has to be a wage slave in order to be free; in which he has to be denied access to the ground of his freedom (that is, property) in order to participate in “free” markets. But is this a proper definition of freedom? Is it even a proper definition of economics? I believe that the author has made two fundamental mistakes: one, he has reduced all markets to monetary markets, and; two, he has confused the “free market” and “capitalism” as if they were the same, when in actual fact they are more often things opposed to each other.

A purely “monetary” exchange market is problematic in several ways. The first has to do with the nature of money, which should be merely the unit of account for all the circulating goods within a given economy. However, money can too easily be manipulated apart from the market for real goods and services. The Americans have proved, beyond a shadow of a doubt, that trillions of dollars in financial wealth can be created without having any relation whatsoever to real wealth. Men who contributed not so much as a grain of wheat to the commonwealth are paid billions from the common purse in reward for their failure. And this was done by men operating in largely unregulated markets. Money, as a unit of account, is an abstraction, and the more abstracted an economy becomes, that is, the more monetized, the more easily it may be manipulated by those “in the know” about the mechanics of abstraction, and a completely monetized economy is the easiest of all to manipulate.

The truth is that man operates in several markets simultaneously, most of which are not monetized, and all of which serve are checks on the other. When all markets are monetized, all markets fail, and fail decisively, without any hope of recovery. The first market in which we operate is the gift economy of family and the community. We are first called into being by the ready-made community of the family, and from this community we receive a variety of gifts. Our being, to be sure, but also the gift of our name, our family, our language, our first moral perceptions, our first experiences of love and belonging, and so forth. This economy of grace (gifts) is the primary economy, and all other economic and social activity must be judged from the standpoint of how will it serves the family. Without this check, there is really no way to know whether the economy “works” in any concrete sense. A fully monetized economy erodes the gift economy of the family upon which the whole social order depends. Beyond this family economy, there are economies of community service, economies of political activity (in which votes are the medium of exchange), religious economies, and so forth. All of these depend on the economy of production and exchange (note both terms), and hence are checked by that economy, even as they provide checks for the exchange and production economies.

Mr. Cucerai states that capitalism “opens a space previously unknown to human freedom.” But what he does not mention is that this must be a very small space, one occupied by the possessor’s of land and capital alone. That is why we call it “capitalism.” Indeed, the very fact of denying access to the means of subsistence to most men means that a few will end up in possession of the vast bulk of these means. This point flows naturally from Mr. Cucerai’s own description of capitalism, but it is the crucial point which he has left out, and without which his description cannot be considered complete.

Not only is this concentration of capital bad morals, it is bad economics and bad social theory. It is bad economics because all market theory is based on the “vast number of firms” hypothesis, which states that production is spread over such a vast number of firms so that no firm, or no possible combination of firms, can have any influence on market prices; that is to say, they are all price-takers rather than price-makers. When you have consolidation in any industry, the whole basis of the free market collapses, and monopoly and oligopoly are the result.

But that is just a part of the problem. I will skip over Mr. Cucerai’s preposterous claim that you can have, simultaneously, a rise in production prices and a fall in consumer prices, as if the later were not dependent on the former, to note that rising wages are not the norm in capitalism. Indeed, in the United States since 1973 the median wage has remained flat, even though productivity for all classes of labor has increased dramatically in the same period. This means that the workers are producing more goods, but must purchase them with the same rewards. Since this is not possible, the economy has resorted to three stopgaps to maintain consumption. The first is to put more family members to work, and to work longer hours. The second is to increase the role and size of government to absorb more of the output. And the third is simple usury (consumer credit); have the class that is over-compensated—that is, the possessor’s of capital—simply lend the excess to consumers to soak up the excess goods. But all three methods have reached their logical limits. The family is working as hard as it can (to the detriment of that family life which the economy ought to serve), the government cannot expand much further without discovering those limits on expansion that the soviets discovered, and the credit system has collapsed. There is no further that we can go without changing the system.

Mr. Cucerai assumes rising wages in a free market. Capitalist defenders assume that “free contract” is sufficient to ensure such rising wages. But Adam Smith noted the problems with this theory:

It is not, however, difficult to foresee which of the two parties must, upon all ordinary occasions, have the advantage in the dispute, and force the other into a compliance with their terms. The masters, being fewer in number, can combine more easily…A landlord, a farmer, a master manufacturer, or merchant, though they did not employ a single workman, could generally live a year upon the stocks which they have already acquired. Many workmen could not subsist a week, few could subsist a month and scarce any a year without employment.2

Thus Smith identifies actual wages as the result of a power relationship between masters and workers and not a result of purely “economic” forces; it is power, not productivity, that is arbitrated in a wage contract. An American CEO gets 500 times what the line worker makes not because he is 500 times more productive but because he is 500 times more powerful. The seamstress in a sweatshop gets a pittance not because her productivity is low but because her power is pitiful.

The power to negotiate a wage comes only with the power to say “no” to the terms offered, and this power comes only from the possession of an alternative to the wage. And only property confers this power. Where workers have their own property and can make their own way in the world, any wage contract they accept is likely to be a fair one, one that fairly rewards their productivity. But in absence of a real alternative, there is no real negotiation; you cannot negotiate if you cannot say “no.”

What a free market really requires is free men, and what men require to be free is access to their own means of subsistence, which is precisely what capitalism denies them. The proper ground of freedom is one’s own proper ground, the very ground which Mr. Cucerai would cut out from under the worker. What is denied to the mass of men must fall to a minority of men, men who will then be the masters of society and the effective rulers of government, co-opting it to their own ends. This is what has happened. The higher the piles of capital gathered in a few hands, the thicker the walls of government necessary to protect that capital, and capital and government combine to limit freedom, to restrict property. Capitalism is therefore not to be confused with the free market, but to be identified as its mortal enemy, and to confuse the one with the other is to totally misunderstand the reality of modern economic, social, and political life.

Mr. Cucerai is to be praised for his almost unflinching look at capitalism, but he is to be critiqued because, at the last minute, he flinched, he looked away from the logical consequences of his own description to skip the crucial point upon which the whole discussion must turn. He went to the edge and turned back just a hair’s-breadth from the truth. But we cannot turn back, for only if we have the courage to look at things as they are can we expect to have the strength to make them what they ought to be.

26 comments

Mike

There’s a big, glaring problem with the premise of point #3 in that capitalism does NOT force people to seek a monetary source of livelihood, but that it ALLOWS people to CHOOSE whether or not to do so, and almost all people choose to do so. There are many people that choose to live off the land in Appalachia or remote parts of Texas (I’m from Texas) and keep off the grid. However, most people choose not to life this rougher lifestyle.

The second big, glaring problem is that barter is not disallowed under capitalism as point #4 asserts. Money is simply a more efficient store of value than sheep, smooth rocks, or wampum, so most people demand payment in a stable currency.

Due to the false premise of #3 and the falsehood of #4’s assertion, the rest of the following statements that are built on #3 and #4 are misguided and false.

Bruce Smith

John. I like your essay very much. It reminds me of the statement by John Ball, one of the English 14th century Peasants’ Revolt leaders, who said:-

“When Adam dwelved (dug) and Eve span (weaved) who was then the Gentleman? (owner of capital)

I guess if he was reborn today John Ball would be saying something to this effect:-

“Originally human beings took from nature what they needed to survive. Despite the commoditization, or capitalization, of nature the moral purpose of society remains to make sure everybody has a fair slice of this cake irrespective of this change in nature’s status.”

rex

Mr. Médaille,

I am going to chime it with Kurt9 (Comment #4), a distinction needs to be made between capitalism as practiced by corporations and capitalism as practiced by individual entrepreneurs. Corporations are private tyrannies that are designed to reduce investment risk, gain wealth, and accumulate power.

You are absolutely right regarding the growth of government as a result in the growth of [corporate] capitalism. As long as corporations have more rights and fewer responsibilities than individuals, you will need governments to keep them in check. The larger and more risk free corporations are, the larger the government will have be to control them. (Unfortunately, as a corporation exceeds the geo-political jurisdiction of the government tasked to control them, that corporation begins to exert undue influence on that government. But that is a different topic.)

Individual endeavors in capitalism are limited by risk which intern limits access to resources. If you give an entrepreneur (and his investors) protections against civil, criminal and financial liability, that enterprise becomes much less risky as an investment and more capital is available. In short it becomes a corporation and the purpose of the business has changed.

Does the individual entrepreneur need to be regulated by a government? In a humane society yes, I believe he does. However, that level of control is orders of magnitude lower than in the corporate model of capitalism simply because the level of economic development is lower.

I enjoyed your essay, and I think we agree on most points, however, it was a little unfair to introduce “free markets” in the second to last paragraph without a suitably developed definition. (Sloppy thinking and spin doctoring in the past few decades has confused the definition of “free market” to the point the term has little meaning anymore.) Perhaps it is me that has a sloppy definition of “capitalism”? Under your definition of capitalism, can capitalism exist without the corporation? If it can, then perhaps it is the corporation that is both the child and the enemy of the state.

John Médaille

James, I’m not sure what the problem is. I have stayed out of the post-modern conservative debate because, amidst all the talk of brave battles, I didn’t quite see what was “post” in their modernism. The modernism was clear enough; the rest is a bit hazy, at least to me, But I suspect any modern will have difficulties with this particular “post” (that is, pre-) modern. I think “modernist conservative” is a contradiction in terms, like “neoconservative,” conserving everything that is new-fangled. At the same time, I have to confess that for me, “new” is the Enlightenment or anything afterward.

James Matthew Wilson

Much though I admire Bob Cheeks and all the fellows at PoMoCon, I’m a little surprised that he is incapable of reading your work, John. I thought it rather straight forward and so am astonished by the clouds of misapprehension.

While I’m very pleased with much that FPR has done, I am personally most grateful for the series of Distributist essays and now this one, all of which articulate with a businessman’s clarity the mechanics of distributism and its distinctions from the supposed “two ways” that are really just “one way” in our modern statist world. Altogether, I think they will do the careful reader a world of good: they are attentive and detailed in a way very much necessary, given the poetic achievement but argumentative imperfections of so many earlier Distributist writers.

This essay illuminates as few others could. As I mentioned in the comments following the “Awtarky” essay, one thing we require is a precise definition of capitalism, and here you provide it. For what it is worth, I had tried to define capitalism in cultural terms, i.e. capitalism exists only when all social relations are mediated by the monetary market. You provide a rather more empirical one: capitalism is that condition where all members of a society must enter into the monetary market (regardless of whether other markets or relations might still exist). That sounds right.

John Médaille

I always find these charges amusing, precisely to the degree that they are unsupported and irrational. The last I checked, distributism was the idea that everybody should have some property, and socialism the idea that no one should have any property; Cheeks et al. are always a bit vague on the connection between the two, even as they insist there must be one. The people who make these charges always seem to have difficulty citing any evidence, but on the other hand, evidence is meaningless to the ideologue. I have also noticed that those who shout the loudest have the least to say, and their only connection with logic is the logically fallacy of the ad homenim, a technique Bob Cheeks amply displays in his latest tirade.

Bob Cheeks

Dear Olde Pal D.W.

I knew something had happened. I’ve just contacted Fox Muldar and Scully and they’re on their way to Conn. to see you.

Re: Medaille, he’s a totally screwed up redistributionist/socialist, i.e. he would take YOUR wages/earnings and redistribut them. Dude, the way I read you, you were against that crap! John can shove it, I fight commies, I sure as hell don’t join them!

I have no problem with Medaille’s retrot. He can retort all day for all I care. It’s his ideological disorder, his psychopathology (and Caleb knows exactly what I’m talking about), that I find offensive…and I do hope he has as a come to Jesus moment, and it appears it’ll take divine intervention in his case.

I attribute your current condition to the aforementioned enviro-weenie torture session, which, I’m familiar with because I used to run with the Sierra Club dudes/dudettes who were really wacked out.In the end it will make a better paleocon of you as soon as the meds work themselves into your blood stream.

D.W. in the end we’re all responsible for what we know. I like you because you’re quick witted, a terrific writer, and, I thought, shared with me a certain antipathy toward the concept of central gov’t and all the evil possibilities therein. Whether one or the other of us drift into error, become confused, or whatever, I’m still a pal of yours.

We can always pick fights each other!

BTW go here for my latest blog at PoMoCon: http://www.firstthings.com/blogs/postmodernconservative/2009/06/21/love-the-sweet-divine-

Also, my personal email is: robertcheeks@core.com drop me a line.

D.W. Sabin

Cheeks,

While in Oregon, I was shanghaied by some Black Block Greens , tied to an ergonomic chair with hemp rope, force fed granola with un-toasted filberts (a Green Party Waterboarding) , made to listen to hours of Nirvana and Bjork while being worked in a sweat shop making Peruvian Beenies out of plastic shopping bags as some Ashkenazi Maiden dressed in repro Earth Shoes read the Greatest Hits of Tom Friedman to the point that I fear for my life without the protection of some big strong neo-cons on a debt spree bombing the wogs on my behalf.

Come now Mr. Cheeks, you take sides too easily for a man of such enthusiasm. Teeth grinding reduces one to gumming. Mr. Medaille can be a little sharp in his retort but it’s only like climbing Limestone cliff’s, one just needs to pick ones way as one proceeds toward the view.

Equanimity is for the post-lobotomy set.

Daniel

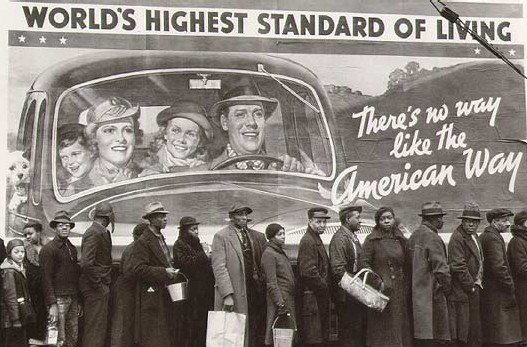

What an amazing/ironic picture!

John Médaille

Clare, “phronesis” aside, I will note that while pomposity in language is a poor cover for paucity in thought, it is even a worse cover for slander. I have never supported either central banking or the system of private money creation that makes the central bank necessary. What I do find amusing is the folk who support the one but not the other.

I also find Woods amusing in that, for an historian, he is completely ignorant of history, as demonstrated in the quote you so kindly provided. But then, it would be difficult for him to talk historically of something that has never existed, and the Mengerian gold system of which he speaks has no history, nor any possibility of one.

But I do note that once again, you have avoided the questions posed. So what else is new?

Clare Krishan

John is correct to note that he and I have disagreed elsewhere on what we mean when we say “capitalism” and “natural.” My malapropisms aside, I acknowledge that phronesis permits of such differences: a deficient application and a superfluous application may both be erroneous. Belloc along with Frs Fahey and Coughlin all decried, as I do, central banking. Yet instead of abolishing it as Belloc called for, John follows the men of the cloth in assuming public concupiscence is the remedy to the private variety. I know not why. Here’s a pointer for those interested in the details, Tom Woods at http://www.mises.org/story/1860

Silus Grok

Thank you. Much obliged.

John Médaille

Wikipedia has a fairly good discussion of rent-seeking

http://en.wikipedia.org/wiki/Rent-seeking

Silus Grok

I’m still working through the particulars of the article … but point seven — specifically, “In absence of the state, commerce would be a matter of rent-seeking, a behavior only government regulation can prevent” — needs a little more flesh for me to sink my teeth into.

I’m not sure what “rent-seeking”, here, means — could you put a little meat on these bones?

John Médaille

Dirk, I am more likely to say “Down with THIS gubmint.” Man is a social being and naturally organizes himself into rule-making hierarchies in order to get anything done. We would prefer a flattened hierarchy as local as possible, but some sort of ruler we will have.

But let me add that to say “down with capitalism” is equivalent to saying “down with this government.” If you have the kind of economic system we have you will have the kind of government we have; the two go hand in hand and and grow together. The proof of this is that it is what has always happened.

But it is no longer necessary to shout either phrase since, as you point out, they are taking themselves down without any assistance from us.

Bob Cheeks

I don’t know who this is, but it ain’t the old D.W.!

John, I can’t read your essay or we’ll do “Commies and Patriots, Part II,” and I doubt either one of us is in the mood for that.

D.W. Sabin

Having just strolled over from the mosh pit of the “Face Right, Move Left”, essay and its comment stream, I want to stress that while reflexively anti-statist, I am neither ungrateful for the wonderful life we still have the opportunity to lead in the lapsed Republic nor impervious to the benefits of judicious government. While I may scream “Down wid de Gubmint” while shakin a charred shankbone, I do so more out of a sense of remorse at what has been lost in the process of building this Rube Goldberg consumptive State than out of any blanket antipathy to government. The trend does seem to be that Government would screw up a one car funeral procession but it has also done some good things.

However, one need only look at the combination of our Military Budget coupled with an astonishingly accelerating debt service to know that the U.S. Government, as it develops new or services old entitlement programs will be forced to both tax more and provide diminished levels of service in a deteriorating cycle of diminishing returns. Adding family leave or for that mater, any new entitlement program will come to no good…..under the current system. Knee jerk antipathy to this current government seems the only prudent behavior.

John Médaille

Dirk, I am not actually antagonistic to libertarianism, only to its Austrian mutation. As Marx ruined socialism, Mises ruined libertarianism.

John Médaille

Claire, I confess that I cannot even parse most of your sentences, much less understand them. But for the bits that I could understand:

Of course “ought” is derived from “is”; what else could it be derived from? The good, the true, and the beautiful are the ontological transcendentals, or at least they are in Christian philosophy. Of course, there are non-Christian ontologies that assign these to separate realms, but I am assuming most of our readers are not dualists.

I wish that money production was a gov’t monopoly, but it is not; money is created by banks issuing credits. Sometimes the central bank creates money (although not often) but that is a private bank as well, one owned by the federally chartered banks.

Further, it is not legal tender that is the problem. The coin of the price is always the law of the land. As Aristotle pointed out, some time past, “Money (nomisma) is so-called because it derives not from nature but from law (nomos).” There has never been any regime of any kind that did not define legal tender, for without this commerce would be impossible. Of course people can, and do, engage in barter, but we generally find commerce easier with money. That being the case, money must be defined outside the system. I know you believe in Menger’s “goldbug” theories, but they are crack-brain. As I have asked you many times, and you have always refused to answer, how can money be BOTH a commodity AND a unit of account? The pound is a unit of account for weights, but if today it is 16 ounces, tomorrow 12 and the next day 20, there would be naught but chaos. One only has to look at the daily kitco gold chart to know why Menger is wrong. There has NEVER been the “natural” money as you claim, for money is not from nature. I have challenged you on another blog to provide an example, and like the commodity question, you will not respond.

You confound the seizure of the monasteries with the right of coinage. I have no idea how they are connected. The monarchy coined money for a long time without seizing a single abbey. But you are right that the seizure created the capitalist economy at a stroke; it was the “primitive accumulation” that made it possible.

The comment that China is “distributism’s Big Daddy” is merely gratuitous and unfounded, and needs no reply.

Clare Krishan

[ My bad – nondelimited nested text! Here’s how I intended my comment to look ]

Thorough take down of crony capitalism, so far as it assumes we all mean that form of human corruption wrought by a concupiscence that has no name (the “silent hand” classical Northern European economics school of Friedman et al). Not all fans of free enterprise subscribe to this means of deriving a just price, not all “libertarians” make the materialist error of deriving “ought” from “is” as Mr Medaille would have you believe we do:

Where did the Romanian get his “ought” from an “is”? IMHO this is an argument from justice resting on an incorrect definition of “money” production as government perogative to an absolute authority we may not surrender to them, the valuation of the natural goods we are endowed with by our Creator. The natural medieval self-sufficiency ‘a season in the sun’ (10 weeks) wasn’t guaranteed by govt. was it? The King arrogated himself that right in confiscating the monastic estates and henceforth has the Protestant English school of economics been inherently mercantilist and unjust.

But Mr Medaille wouldn’t seem to recognise the fallacy, for him that error is a given:

but then irrationally lays the blame for the ills of an unfettered “market”

at the feet of his own erroneous definition?

Perhaps I can rescue the argument from justice by paraphrasing replacing an abstract neutral “monetized” with a more concrete reference to positive law: “A completely “legal tendered” economy is the easiest of all to manipulate,” since it is not the fault of money at all, but the dictat of the public authorities to proscribe what kind of money you will use to tender your debts of taxation that they levy on you, AND more tyrannically the kind of money you may use to settle debts to partners in exchange. We owe our neighbors a debt of charity, to feed the hungry, to clothe the naked, to nurse the sick etc etc but who the heck said it is reasonable that the only legal way to do this is by exchanging value in Federal reserve notes? Not any libertarian of the Austrian School I know of, but rather too many crony capitalists of the Cato Institute do imply that’s compassionate conservatism, right?

There have been natural monies, and they were traded in markets as readily as milk and honey can be bartered for. The problem happens, as Mr Medaille ascribes, when “power” is reserved to the wrong authority, taken from the individual free agent (gifted by grace) and residing in the aggregate collective (not receptive to grace, per se, only that enshrined in law can be “accounted” for). A narrative perhaps may illustrate the point – you may have access to land and a cow for your lifetime, and the liberty to commit to certain complexites of making a living in dairy products, ie to elect to sell milk, butter, cheese or dulce de leche with a Mars logo on it. Traditional community wisdom has settled as a rule of law that the government fixes the prices used to settle “accounts” raising and lowering them to maintain another aspect of traditional community wisdom, the Bee Friends Association, to funnel funds as revenue for the distribution of honey to its social welfare dept. who collect and apportion all the pollen in the land to those who enjoy la dolce vita by maintaining a worker-bee “hive”. Whenever more folks signed up for la dolce vita, the honey supply is extended on credit from the worker bee hive of a neighbor. Liquidity of domestic milk will be increased by diluting with Government legal tender water, with the increase in volume used to “account” for liabilities to the neigbor (since your traditional community wisdom calls these things “savings” to encourage the form of “capitalism” you need to maintain the milk and honey economy of the democratic republic of Bee Friends.)

This kind of institutional usury has been practiced by central banks since their inception by mercantilist govt’s (as Bee Friends associations for those who like la dolce vita). Works so long as the neighbor isn’t a better mercantilist than you, then honey becomes compulsory, and milk is banned. Watch China… distributism’s Big Daddy.

D.W. Sabin

Yes, the “Economy of Grace” is an elegant term….providing a vivid distinction between the efficiently graceful self-sufficiency of Aristotle’s bottoms up “natural” economy vs. the staggering booms and busts of the top heavy monetized “unnatural” economy, divorced from the ground we stand on…or, more properly perhaps; greatly distanced from the ground we stand on. We do operate in many markets simultaneously and this is as it should be in order to encourage the checks and balances that avoid the chaos of the current “all-in” economic farrago. Unfortunately, those “many markets” are now winnowed down to fewer and fewer venues not fully subservient to the State-Corporate Combine and it’s monetary syndicate. There is a chaos and disruption of atomized economies and a countering chaos of the current system and somewhere, there must be a form of if not stasis, at least acceptable stasis not plundered of the dynamism that produces vibrant culture.

While the monetized global capitalist system created wealth, technological marvels, efficiencies in production to distribution systems and a common forum ,while nearly obliterating the plague of parasitical “Bosses” that dominated a more atomized economic model, it seems the current model has passed a productive point in its cycle and is now overly consumptive and near as chaos-prone as the former atomized model….if not even more catastrophic in its chaos. We have stayed ahead of the “external costs” waste stream for a good long while but that is no longer the case. Population growth alone would seem to indicate the game is already lost but Malthus has been proven a tad pessimistic already.

Suffice to say, we have invested heavily in a system that appears to possess a productive upward curve but is attached to an equally dysfunctional downward curve we inhabit now and like any addiction, the choice to detach is a hard one , made harder still because of the lack of any concept regarding alternatives or even a fundamental understanding that there is a need to assess any better alternative. To oppose the motherhood issue of capitalism as it is manifested today is to be deeply unpatriotic. There are choices and understandable choices but they are part of a “Forbidden Knowledge” that is either shunned or rebuked by those powerful few who continue to benefit from the existing paradigm as it descends more deeply into a corrosive entropy. There may come a time when the powerful will lose that power in the destructive chaos of a continuing diminishment of wider benefit but at that juncture, one wonders if the prospect for meaningful correction is possible. History would seem to place dim odds on this prospect. The Monetized Technocratic State is entering increasingly dangerous territory where corrective measures are short term against a longer term cycle of increasing trauma and if we are not to become Lemmings racing to the cliff, we need to analyze those definitions we take for granted and not expect that our inbred media and political-corporate elite will be at all helpful in pulling us back from a jump off the cliff.

While I understand your antipathy to libertarianism, I think your blanket condemnation of it as nihilistic over-states it and fails to give credit where credit is due to those like Nock, Hayek, or Garrett or Rothbard, Rockwell and Mies who have been deriding the crypto fascistic nature of the militant State-Corporate combine for some time…..frequently being the only force to keep alive an idea that the paradigm we automatically follow is deeply dysfunctional. Again, it is in the Checks and Balances of an educated dialogue that we might find a more useful system. Personally, I think the bait and switch has been more on the part of the Statists using libertarian dogma to their credit where it suits them in propaganda but in effect, drawing those attracted to libertarianism with propaganda alone while executing policy against their interests when elected. While the resulting consolidation of Statist monopoly might have resulted from this bait and switch to a degree…with the mugwump libertarian as an actor within it , it is certainly not the prime reason for it. Many continue to deeply believe that this government will actually work in their interests despite ample evidence to the contrary on a near daily basis. The emerging medical debate will surely provide a classic example of a three hump camel masquerading as a horse. Perhaps CSpan might turn its camera on the New York Statehouse and its sordid activities of just yesterday as a means to demonstrate the advanced decay of our political process of monetized special interest, frenzied partisanship, inept leadership and formulaic pandering.

That said, you continue to provide compelling and thought provoking reading…..the idea that I’m a High Tech Hut Tax Wage Slave cheered me up…in my favorite dyspeptic way…… to no end. No wonder I like African music.

kurt9

This essay confuses corporate socialism with true free market entrepreneurial capitalism.

polistra

>>This economy of grace (gifts) is the primary economy, and all other economic and social activity must be judged from the standpoint of how well it serves the family. <<

Says it all.

It occurs to me that we have several examples of economies of grace interacting with the economy of money, and all succeed beyond normal measures of skills and productivity. Catholic parochial schools, Mormons, Amish, and (to a lesser extent) immigrant communities like Koreans. So we don’t need to think of the economy of grace as an Eden-like unattainable condition.

brierrabbit3030

Very well put. You always have interesting things to say, about capitalism, that don’t get discussed much. Even though every one knows something is wrong, but they can’t articulate it. Or don’t dare.

Comments are closed.