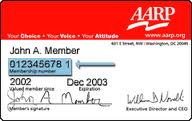

Of all the downsides attendant to turning fifty, none annoys quite so much as receiving membership offers from the AARP. The junk mail invites a response to the effect that one is not inclined to join an organization whose sole purpose is to block all legislation designed to keep us from screwing over our grandchildren, but instead it usually ends up in the recycling bin.

It turns out, however, that one underestimates organizations such as the AARP if one sees them simply as an interest group serving a particular and narrow set of interests, even if it does have 40 million+ members (out of 98 million persons over 50 in America). Ted Lowi’s well-known The End of Liberalism argued that public democracy as governed through representative institutions had waned in America and been replaced by “interest-group” liberalism that exercised control over the public sphere through the influencing of bureaucratic management. An essential part of Lowi’s claim is that interest-groups and bureaucrats form their own client relationship, at times only marginally attentive to the interests of their members, in the case of one, or citizens, in the case of the other.

Indeed, in policy areas of great size and complexity the tendency of policy to fall out of the realm of public scrutiny and into the hands of “experts” and insiders becomes even more pronounced. A public either bewildered or overwhelmed or made indifferent will only feebly exercise the sorts of oversight required to keep these actors in check. Walter Lippmann in his classic The Phantom Public compares these citizens to deaf spectators in the back row at a theater: they know something is going on, but know not what. Lippmann noted that “rules and regulations continually, taxes annually and wars occasionally remind him that he is being swept along by great drifts of circumstance” and that such a person doesn’t know “what is going on, or who is doing it, or where he is being carried,” living in a world “which he cannot see, does not understand and is unable to direct.”

Convinced of his own inconsequential public existence in the “foam of events,” the modern democratic citizen recognizes that he is not the sovereign or omnicompetent figure he is made out to be, but is constantly addressed as if he were by those who profit most from the complexity and scope of modern policy formulation. This myth of the democratic citizen, like all abstractions, serves the interests of those in power not simply because they think they know best and ought to govern anyway, or because they love power, but because they enjoy these and other advantages of the bureaucratic state.

In our contemporary politics nowhere does this complex reveal itself more completely than with an organization such as the AARP. The House Republicans, suspicious of the AARP’s machinations during the passage of Obamacare, began an inquiry into the finances, holdings, and operations of the organization. Recently, the Capitol Research Center produced a paper examining the AARP and how it benefited as an organization from Obamacare.

Between 1998 and 2010 the AARP spent $198 million on lobbying activities, while it took in $1.176 billion in revenues in 2010 alone. It currently has assets totaling over one and a half billion dollars. The main source of revenue for the organization is not membership fees, but rather the $670 million it received in 2010 as a result of its contract with United Health Care, a provider that stood and stands to take in massive amounts of revenue due to holes in the Medicare system’s coverage.

These holes are there intentionally, of course, and lawmakers, not overly concerned with the needs of average citizens, who couldn’t be counted on to work through the Byzantine code anyway, and who would be helpless once the burdens became real (the percentage of my household budget spent on medical insurance and care tripled in the one year following the passage of Obamacare), happily provided these gaps to companies such as UHC and groups such as the AARP. Indeed, Congress can hardly be said to have written the legislation, so prominent was the role of bureaucratic agencies and interest groups. Organized interests are not merely interests, they are organizations, with their own internal logics and pecuniary demands which can be masked by appeals to “public interest.”

Spend some time perusing AARP’s ads. The constant upshot is to get seniors riled up by the idea that Washington is threatening senior’s benefits to pay the government’s bills, ignoring the obvious fact that the bulk of those bills are precisely those benefits. All this with an underlying tone of “You better not mess with us.” This demagoguery is in part grounded in reality, but is largely rhetorical excess. Still, seniors are uniquely vulnerable, particularly in an age where their children have either moved away or, even if nearby, are all-too-frequently eager to warehouse their parents in assisted care facilities so they can keep pursuing their own vision of the American Dream.

Not valued in either the labor market or in their children’s homes, with an extended lifespan and corporately-constructed ideas of a happy retirement and a long and healthy life, the unique plight of the senior requires attention. I confess: I hope to become one myself someday. Such concerns, however, ought not convince us they can’t be selfish, and do not remove them from accountability to the common good. Indeed, the selfishness and self-satisfaction of many seniors, and the renowned self-absorption of Baby Boomers (see Mary Vander Goot’s forthcoming After Freedom), unlikely to attenuate in old age, poses a significant political challenge.

But a bunch of menacing-looking seniors standing in a park with their arms folded insisting that their benefits not be touched are only part of the problem. It’s the group that puts them in the park and takes their picture, claiming to be a non-profit while at the same time sitting on over $1.5 billion in assets, that represents the pathology of interest-group liberalism. This is what prompted the House investigation and the CRC report accusing Obamacare of “crony capitalism.” So long as the AARP gets theirs, and the seniors get theirs, and neither party shows any willingness to take them on (the AARP, remember, enthusiastically endorsed the Bush prescription drug plan), our financial crisis will continue to deepen to the disadvantage of our progeny.

The depth of this crisis can’t be overstated. The CBO reports that public holding of the debt will reach 70% of GDP this year, its highest level since World War II. Although the CBO provides alternate scenarios projecting the future of the debt, the more likely second scenario (“extended alternative fiscal scenario”) will have the public share of debt at 93% of GDP in ten years and 199% in twenty-five (and there’s reason to assume these estimates are conservative). The greatest factors contributing to this rise would be the large entitlements. Indeed, while Social Security, Medicare and Medicaid comprised 2.5% of GDP in federal spending in 1965, they are now up to over 10% and, under CBO estimates, likely to reach 16% by 2037. Within ten years, the CBO warns, “spiraling interest payments” and runaway spending would quickly push the debt into catastrophic regions.

While revenues have remained fairly constant at 18% of GDP, federal spending has outpaced the growth in household income by a factor of 12 (in constant dollars, household income has increased 24.2% since 1970 while federal spending has increased 287.5%). Federal spending per household has nearly tripled in that span. With increases in the three large entitlements slated at another 62%, the tax burden on the average household, in addition to reductions in disposable income, will undoubtedly create pressure from below. (The tax burden per household in constant dollars has increased from $11,554 in 1965 to $19,409 in 2012 – a number that is on the rise and significantly outpaces gains in household income).

The Tea Party has lost much of it mojo, but the underlying causes prompting its existence are unlikely to improve. The coming class warfare may not pit city against country or worker against owner or poor against rich. It may very well pit generation against generation, and in a deracinated society where the provisions of care are no longer taken up intimately and proximately, the two sides may find themselves on a darkling plain clashing by night harming those they ought to love most. The “invitation” I received from the AARP virtually begged me to think not of my children or my grandchildren, but to join an organization that would help me get mine, and in the process help the AARP get theirs. Time was when grandparents sent money to their grandchildren; it’s now the five-year olds who are writing the checks.

If, as Lowi suggests, the advent of interest-group liberalism represents the formation of a “second republic,” replacing the original one of limited government under public authority, the current fiscal crisis may be the beginning of the end for this second republic. But what rough beast slouches toward Washington to be born is only dimly imagined.

20 comments

Siarlys Jenkins

“A good start would be to put a limit on Medicare, such as a max lifetime payout or maximum age of eligibility.”

Actually, we could probably bring medical spending within manageable limits by simply providing that:

A patient who is chronically incapable of giving informed consent will not receive any invasive procedures, including intravenous administration of medication.

nasicacato

Karen, et al.,

Whether it’s due to an unsustainable system crashing, or a reform that makes us responsible for our own medical expenses, I don’t think there is any question that our life expectancy is going to get shorter. We need to come to terms with that.

Karen

Karen,

‘Tax the highest earners’ is not a legitimate solution to medical spending because there are not enough high earners making enough money to make a whit of difference. Let’s assume what you are proposing is the famous “Buffet rule” in its latest form, which is estimated to bring in $30-40B in revenues over 10 years. That isn’t much when the deficit is $1.2T and growing, largely due to medical spending in the medium

term. That is as if you racked up $12,000 in credit card bills and found a way to pay for $35 of your debt. Your borrowing against the future has not changed in any remotely substantive way.

blue sun

Jeffrey,

Thank you for illuminating some of what’s been going on here. AARP has a very benign public image. Little did we know what they’ve been up to in the background all this time. But I guess it’s no surprise, when you think about it.

“The coming class warfare may not pit city against country or worker against owner or poor against rich. It may very well pit generation against generation…” This, to me, is a unique take on our upcoming social strife, and it made me pause. I wonder if this prediction will prove accurate.

Karen

Will, et alia — in order for producers to make any money, someone has to buy what they make. The luxury market is big but it isn’t that big. Impose fairer — read HIGHER — taxes on the highest earners and use that money to make Medicare secure. That way the high earners can continue making money because enough people will have enough security to spend a little cash now on what they’re producing. Conservatives always forget that “demand” part of “supply and demand.”

Will

Karen, you acknowledge that Medicare’s payment for medical treatments for the elderly allows the children of the elderly to have money to spend otherwise. Yet your comment does not address the issue of scarcity, raised by Matt, concerning the source of those funds for Medicare and Medicaid. In order for those funds to be available, someone, somewhere, had to produce something.

Currently, the payroll taxes ostensibly funds Medicare. So those same children who have money to spend because Medicare takes care of their parents are also having their paychecks taxed at 2.9% to pay for it. At the same time and from the same pool of revenues, the federal government runs an annual total deficit around $4300 per person. As Polet points out, Medicare and Medicaid comprise about 10% of federal expenditures and are growing rapidly. (All of this does not include substantial healthcare spending by the states.)

Since the government’s tax revenues don’t cover it’s expenses, someone, somewhere did produce something that allowed the government to spend more than it earned, and much of that on medical expenses. Those people lent the government money, but they must be repaid. Therefore, our government is truly borrowing against taxation on the future labor and income of future generations to pay for medical treatments today. Is this fair to those generations, many yet unborn, to be faced with the debt from medical care for today’s elderly? Are the elderly in this country to continually leave a legacy of growing debt bondage? This is the path we are on. What if we said that each generation must pay for its own medical care? I find that more fair, but will leave aside the issue for now as to how collectively or individually they will pay for it. The immediate problem with that solution is that the government keeps making promises to up-and-coming generations of seniors that we are increasingly unable to keep. I strongly agree that we cannot go kick elderly people off the Medicare and Medicaid rolls today. We have made a promise to provide those people medical treatment sparing practically little expense. But maybe we should reduce the promise we make to future generations, to people like me (age 25), so future generations have time to plan accordingly. Maybe people who are not yet elderly, but have only recently become eligible for AARP-membership should advocate for some incremental reduction in the medical promises made to them, to fund the existing promises made to their parents’ generation and to benefit their children’s generation. Yet AARP and any that support its cause stand in staunch defense of the status quo, unyielding in defense of the privilege of the present to borrow against the future.

Karen

This get to the heart of things: the best thing I can do for my grandchildren is make sure my sons go to college and get a stable job in the upper middle class. Having money immunized its possessors from everything from divorce to stress diseases. No one here wants to acknowledge that fact. Medicare means that more of us still working age have money to spend on things that aren’t our parents health care, meaning that people will be employed to provide those other goods and services. Without demand there is no capitalism. Who’s going to buy what anyone makes if we have to spend all our money to keep from dying? Where will we get the money to pay for Mom’s insulin if no one has any money to buy anything?

Karen

Actually, Joan, I agree with you. There are lots of things that affect the state of our health, most of which are beyond our control. What I want acknowledged here is that effective treatment is expensive, but that failing to get it means disability or death. I, for one, don’t think a just society allows people to die because they, or God help us, their parents, aren’t trust fund babies. In 2007 my husband had emergency gall bladder surgery and spent 10 days in the hospital. The bill was $80,000. We had good insurance, help from our parents, and jobs — both of us — so this didn’t mean that my sons had to give up the hope of going to college and staying in the middle class. With the surgery, my husband lived and returned to a perfectly normal existence. Without it, he’s dead. Everyone here seems to think the just result is that he dies and I end up in a smelly trailer park for the rest of my life working to pay off medical bills and my sons suffer all the ills of poverty and trailer parks.

Joan

The assumption I notice on both Matt’s and Karen’s part is that the cost of medical care is a natural phenomenon like the length of the day and wishing that health care here cost what it costs in the rest of the industrialized world is like wishing for a 25-hour day. In fact, the cost of health care in this country is a political phenomenon, pretending to be a market phenomenon but in fact built on legalized monopoly, legislated exceptions to patent law and other political chicanery. American research into the causes of cancer just about fell over and died in the 1960s and has revived only when a particular cancer looks like it can be pinned on a non-controversial cause such as a virus or a gene. The obesity epidemic includes not only humans but also pets, wild animals that live near us and even laboratory animals, which get a standard diet, but nobody respectable quite dares to suggest that it might have something to do with one of the many chemicals, new or formerly rare, in our air, water and food. That might hurt someone’s income, and everybody knows that income is the real measure of well-being in a capitalist society.

robert m. peters

There is no right to life. There is no right not to die. There is no right to use the force of government to appropriate the earnings of another to deal with my own health issues. With that said, some of us, particularly those of us who do not have an eternal view of things, are in a hard spot. I know about the hard spot, for I am a diabetic with all of the associated and potentially associated problems. I have a burial plot in a family cemetery. I have pre-paid my funeral, a frugal affair if you will. My long-term retirement plan is excellent; my short-term plan leaves a lot to be desired. In the meantime, I carry on my struggle with my partner, diabetes. We are married unto death do us part. She ultimately gets the raw end of that deal, for she will not survive death, but I will.

Matt Weber

I guess in Karen’s world, everyone lives forever.

Karen

Actually, I have a further comment. In Matt’s world the Kardashians get infinite medical care and teachers in poor school districts get none. He allows rationing according to the ability to pay, so those who can’t pay die.

Karen

Matt, you’d best hope you never get sick.

Matt Weber

I don’t know what anyone “should” do, but I do know that if 3 people need penicillin and there are only 2 doses, then one person is going to go without. I don’t want to be too pedantic, but economic scarcity is an actual thing that has implications, and while it would be wonderful to give everyone infinite chemotherapy forever, it just ain’t going to happen. The most sensible solution seems to be to let people pay for what they can pay for and that is that. I am fine with anyone spending themselves into the poorhouse to save their own lives, but could they have the courtesy to not spend me into the poorhouse as well?

A good start would be to put a limit on Medicare, such as a max lifetime payout or maximum age of eligibility.

Karen

Matt, if someone can’t pay for her chemo she should die? If she can’t pay for her daughter’s chemo, the little girl dies? Which brings up an interesting issue: should parents who can’t pay for all expensive medical care their potential kids might need simply be sterilized? Kids don’t make money, they can’t pay for their own care, so should they not exist? When even hardworking people exhaust their savings because of expensive illnesses, those people should just die?

Matt Weber

Well that depends on whether you think people have a right to consume services that they cannot pay for by their own efforts. If you do, then a lot of people will be screwed. If not, then no one will.

Karen

So, Matt, how does that work? Who gets screwed?

Matt Weber

The alternative is to either spend less now by choice, or spend less later by necessity.

Karen

So what are the alternatives? My mother-in-law died of pancreatic cancer two years ago. Even without chemo, her medical bills were more than $100,000 for six months. Paying that bill would have wiped out my kids’ college savings. Instead Medicare paid $60,000 and her teacher retirement insurance paid another $20,000. That left her estate liable for $20,000, which it easily covered. If she’d saved for that kind of medical bills, she never would have traveled at all after her retirement.

I’m really interested in your ideal world on this. What should happen?

Reader John

A Boomer who’ll drop AARP if there’s ever a renewal (or is it the Hotel California?), I’ve recently begun appreciating how burdened the generations behind mine are by the huge benefits we’ve been promised. I try to cut them some slack when (as a consequence?) they seem excessively money-focused. But I think the Ponzi scheme economy will collapse before mandatory euthanasia of the elderly gets rolling. Then maybe we’ll all be in it, scales fallen from our eyes, and we’ll rebuild the world according to FPR values.

Comments are closed.