WASHINGTON The Obama administration is considering asking Congress to give the Treasury secretary unprecedented powers to initiate the seizure of non-bank financial companies, such as large insurers, investment firms and hedge funds, whose collapse would damage the broader economy, according to an administration document. Washington Post.com March 24, 2009

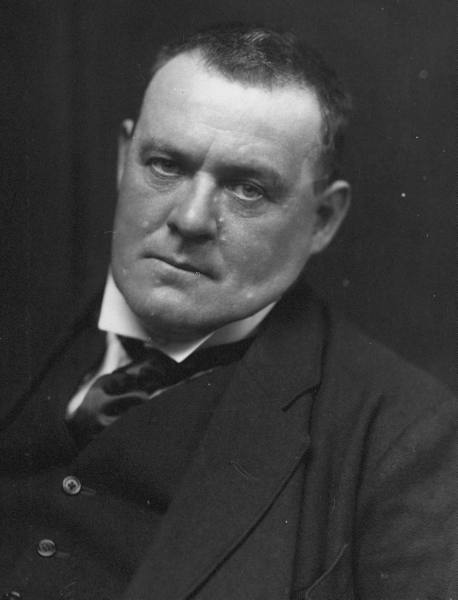

RINGOES, NJ. In 1913, before either World War, before the Great Depression, while Woodrow Wilson was President of the United States and the Model T was only five years old, Hilaire Belloc looked forward and anticipated our moment. He argued that what we today call corporate capitalism was fundamentally unstable and would eventually cease to exist.

The instability would be caused by the slow but inexorable concentration of property into fewer and fewer hands. As property became concentrated, power also would become concentrated, and concentrated power is a threat to the state unless, of course, it is co-opted by the state. Furthermore, as property became concentrated, the security of individuals would be threatened. People would find themselves in the precarious situation of living paycheck-to-paycheck. Because they possess no capital, they would not be able to provide for themselves in the way that a small farmer or craftsman could. They would be completely dependent upon their wages, and when economic crisis struck and wages were threatened, the insecurity of their situation would become acute. In such a time, it is not hard to image the people clamoring for a solution, rejoicing over a new kind of leader who promises change, if only he is empowered. Yes we can.

According to Belloc, the most obvious solution to this economic instability, the path of least resistance, is the acquisition by the state of the major economic interests, e.g. collectivization. This is sometimes called socialism, and, according to Belloc, it is the most natural course. But socialism is not benign or even honest, for the collectivization of property under the authority of the state results not in a more just society but one characterized by glaring inequalities and the loss of freedom for most. As Belloc puts it, “in the very act of collectivism, what results is not collectivism at all, but the servitude of the many, and the confirmation in their present privilege of the few; that is, the servile state.”

When the Obama administration considers seeking the authority to seize companies whose failure would threaten the economy as a whole, it becomes clear that Belloc was onto something important. The argument is not hard to see. It’s a matter of national security. If the firms are allowed to fail, the national economy will suffer a serious blow, and the consequences would be felt around the globe. Collectivization begins to look like a moral duty. Add to this the frightened masses demanding security, and the outcome is all but a foregone conclusion.

The unlikely alternative is what Belloc calls the “distributist state.” It is characterized by widely distributed private property so that the general character of the society is shaped by individual property owners. By “property” Belloc means “capital.” That is, property that can be used to make a living. When a critical mass of citizens possesses capital and are therefore economically independent, a stable situation exists. According to Belloc, private property is the only means of achieving security with freedom. Collectivization does, in fact, provide security. The price, though, is freedom.

The choices are stark. The Obama administration likely will continue to seek ways to nationalize the economy unless and until the American people rise up and demand a different direction. Do we even remember this better way? Can we imagine a world of free men and women who own real property and do not look to the state for happiness or economic security? The tide now is pulling hard against freedom. The siren call of government-sponsored security is so very enticing. Will we come to our senses in time?

50 comments

Brett Beemer

Bruce,

Thank you for the explanation.

Bruce Smith

Brett I’m unsure why I have had no response on the Distributism Wiki from FPR. Here’s a little bit more information about their usefulness though:-

http://blog.davewrites.com/index.php/2008/01/09/using_a_wiki_to_improve_town_governance

John Locke is reputed to have made a great deal of money through stock investment in the Africa-to-America slave trade. As I understand it despite being against the trade in times of peace he squared his conscience by believing that it was acceptable when war was being waged, as it was in Africa. The ownership of property as I see it is derived from rights granted by the society you live in. Locke’s theory on property was, I believe, ultimately an attempt to remove the ownership of property from the oversight of society. In today’s economies it is financially beneficial for society to have the institutions, laws and regulation in place to regulate both property and finance. For example, we have recently seen governments (tax payer citizens) having to act as lender of last resort to the financial system that was undermined by massive fraud in the United States. Where the US government chose not to do this in the case of Lehman Brothers then the bankruptcy laws would come into operation to ensure there was a fair and methodical unwinding of the corporation’s affairs. Both of these activities came about as a consequence of democratically determined laws. Unless you have effective oversight of property by society you end up with crony capitalism and economic royalism as we are witnessing in the United States. The lack of over-sight has seen amongst other things a long term decline in real wages that was masked by cheap credit through unrestricted purchase of dollar denominated financial investments by foreigners which created stock, housing and real estate bubbles which ultimately hit an inevitable demand limit.

Brett Beemer

So has Bruce’s suggestion moved forward here or is it located on the “Society for Distributism”?

I also have a question about Locke’s Theory. Did he believe we have a right to our body unless we are a slave? This would seem to imply we have no real rights as anyone could be made to be a slave. If a slave has rights in his body how could he justify slavery?

I also wonder about the person who works the land should own it. If I pay a laborer to work the land who should have ownership of the land? Are we saying that the laberor sold me the land (at least the use of the land while he farmed it) or at least the produce?

If the worker now owns the land (because he is working the land) does that not mean the young will own more than the old as they are able to cultivate more land by strength and endurance. Could this not lead society to believe that strength is more important than wisdom.

Also as I have said before trying to get those in power to give up power is difficult. To do that you must have more power than they have. If you use the power of the CEOs against them does that make you much different from them in a moral perspective even if the end result makes things better. Does the ends justify the means?

John Médaille

Bruce, I think that is a good idea. Frankly, I think the distributists have often been lazy, and failed to develop the ideas as an economic system with its own research program, or in their presentation to the public, which always makes it appear as some agrarian throwback or a merely catholic quirk. Time to do some real work. My work has been dedicated to developing Distributism as an economic theory.

But there are a group of young men who recently joined themselves into the “Society for Distributism,” and are now active contributors to the Distributist Review. But they are also doers. One will shortly have a commercial radio program, and another organized a debate last week between Michael Novak, Tom Storck, and Charles Clark (representing Neocons, distributists, and Christian Socialists). We had about 200 attendees. Not a bad crowd for a fledgling effort. When this was first proposed, I said “go for it!” while thinking to myself, “they’ll never pull this off.” But they did. We need to reach out, now that people, more than ever, will be looking for new answers.

Bruce Smith

Mark. There are a several things I’ve been thinking about with regard to your comment encouraging individuals to contribute practical ideas on Distributism. Firstly, I believe that good ideas tend to get lost on blog sites because of the peculiarities of the cataloging system. Secondly, the time has probably now arrived to build a detailed consensus platform, or manifesto, on distributist theory, policies, implementation and methods of building political support. Acknowledgement is made that a great deal of the spadework has already been done by John Médaille and others for modern times. Thirdly, the obvious and fair way I think would be to find someone who knows how to use Wiki software (I believe some database engines to be freely available) to lay down the foundations for building up the body of knowledge. Individuals would then be free to contribute text, collaborate on text and challenge text as per Wikipedia. Fourthly, Front Porch Republic would seem to be a likely candidate to host this Wiki Database given its mission, or vision, statement and hopefully enthusiasm of its founders for such a database. Certainly, I believe it would give this blog site an edge over other sites. Finally, whilst I am enthusiastic about Distributism I am also enthusiastic like others about improving equality in the full spectrum of rights, political, social and civic and not just economic. I would hope any Wiki Database could be suitably labeled to encompass this scope. What say you and colleagues to this idea?

Mark T. Mitchell

John Medaille is having trouble getting this to post, but here are several links offering distributist-based policy ideas. His web site “The Distributist Review” is a treasure trove of distributist thought. Be sure to check it out.

He writes:

At The Distributist Review, we try to suggest actual policies, not because we think they will become policy, but because it’s a necessary part of thinking. See for example:

http://distributism.blogspot.com/2009/01/buy-it-up-break-it-up-fund-it-right.html

http://distributism.blogspot.com/2008/12/health-care-system-and-guilds.html

http://distributism.blogspot.com/2009/01/distributism-wave-of-future.html

http://distributism.blogspot.com/2008/11/dont-bail-it.html

http://distributism.blogspot.com/2008/03/aristotle-and-subprime-mess.html

Mark T. Mitchell

John and Bruce,

I’ve been hearing a lot of Phillip Blond lately. It’s encouraging to see an influential person making distributist arguments. Question: if either of you (or anyone else listening in on this conversation) could recommend one or several practical policies, in the American context, that would move things in the right direction, what would they be?

Bruce Smith

Thank you John.I guess we should still thank Brother Locke for his arguments concerning the Divine Right of Kings although he failed to anticipate “economic royalism”. His tabula rasa argument also seems at present to be fading with neuro-pyschologists going for a mix of hard wiring and nurture. We need as well to thank Brother Marx for his labor theory of surplus value but I also personally think both you and Phillip Blond should be thanked for your perceptive arguments for Distributivism.

John Médaille

Bruce, you have nailed it! The whole purpose of property (according the Tawney) is to be an aid to work, not a substitute for it. The man with his own property receives the full rewards of his own labor, and can compare that with whatever is on offer in the labor market. Bargaining position is exactly the issue. You cannot negotiate if you cannot say “no,” and the man without property generally cannot say no in any negotiation. It should be called “NO-GO-tiation.”

The marginalists believed that free contract alone would guarantee that the parties received rewards based on their productivity. But economists no nothing about contract. Contracts normally arbitrate power, not productivity. The CEO receives 500 times more than the line worker, not because he is 500 times more productive, but because he is 500 times more powerful. The seamstress in a sweatshop receives a pittance not because her productivity is low but because her power is pitiful. Without proper property relations, there cannot be right power relations, and the whole neo-classical “factor shares” equations collapse into absurdity.

Bruce Smith

Thanks John. The points I’m about to make I believe echo yours to some extent.

I think after reflection that the basis of Locke’s argument over our bodies and property comes down to this; if nothing else in the world is owned, our bodies are our own and by extension we can infer from this that our labor is also our own. After this though, the major part missing from his argument is consideration of our bargaining position in the real world for just remuneration for our labor which in turn enables us to secure and retain property. The strength of our bargaining position rests upon two things; how desperate we are for income and the level of demand from the market. In turn demand level is determined by the respective share of profits existing business owners, workforce and government are each able to command which then goes on to determine the level of competition in the market place for products and services. So the whole issue of property comes down in the end to equality of rights which determine your bargaining position, or level of power. Accordingly, today’s primary interest in Distributivism lies in reducing the conflict for profits between the two sides of business owners (currently with captured government) and workforce. This conflict as we know has been a cause of the present economic tsunami.

John Médaille

Mark, EGGS-ACTLY. Property in land cannot have the same meaning as property in man-made things. Property in what we make, using our own hands and our own tools, is by nature ours. Can the same be said of land? I think it can of what we produce from the land (the acorn argument) but not of the land itself. I think the land is mine so long as I am gathering acorns, and ceases to be mine when I stop using it. That is, I have a right of use, not of rent. This, by the way, is Proudhon’s argument. His “property is theft” is really a misreading; he means “unused (or rented) property is theft.”

Mark T. Mitchell

But at the same time, the purely prudential argument for property seems to miss something. When I say something is “mine” I am asserting that this property is somehow attached to me, it is an extension of me in a way that a simply pragmatic argument does not seem to capture.

John Médaille

Bruce, I agree with the paper that the Lockean argument is a sorities. The “exception” is a cop out, since Locke allowed for slavery, and since he appropriated the labor of slaves to the master, he has no natural brake on the amount of property a person can own. Further, he makes no distinction between real and moveable property, when the real issues are about real property. Further, the individualist/collectivist argument involves a false dichotomy.

But what is interesting is that the argument touches on subjects that we no longer consider relevant, largely because we have adopted Locke’s views. So he admits what we have forgotten, that property is originally common and that it is meant to have enough to go around. But Locke both acknowledges and disposes of these issues, so much so that to us they are no longer real issues.

The natural brake on property is the amount you can use, not the amount you can rent out. Rent, I believe, is only legitimate when you rent the improvements, which are man-made and therefore deserving of compensation. But to rent what you do not make is without justification. It is called “individualism,” but is really collectivism, because only some collective stronger than the individual could enforce such a right.

Bruce Smith

Mark. Your question is an extremely good one which interests me a great deal because Locke’s ideas about property seem to both support and undermine Distributivism. There is a spiritual, or religious aspect, at least for mystical Christians in the sense that a Buddhist would ask “who is it that owns this body?”(This the notion of the ego being an artificial construct.) So you can have consciousness with no thought (you stop your mind having thoughts about the past or the future) or consciousness with your usual everyday thought. In the case of the former your body becomes co-determinous with eveything around you (the mystical ecstasy of Meister Eckhart)so where are the boundaries of ownership? In the case of the latter your ego separates you out. So where does this get you in answer to your question? Well probably to John’s answer that property is a societal relation but you have to be pragmatic too. Surveys would suggest that most people in Anglo-Saxon economies believe that wealth discrepancies are too great in our societies. This belief has to come from a moral sense as well as a pragmatic one since property is power. The moral sense I believe comes from the Golden Rule (do unto others as you would like done unto yourself)which is the core belief of every religion.

So this probably doesn’t say a great deal that’s very useful or original and I continue to think about it. Meantime here are a couple of websites that add further thinking to your question :-

http://www.philosophy.uconn.edu/department/wheeler/lecture%20locke%202%204%2009%2008.doc

http://eipcp.net/policies/cci/curcic/en

John Médaille

Mark, it is interesting (to me at least) that JPII uses a Lockean defense of property, tying it to man’s labor. But his context is elevating the labor of man. I am not convinced that this is a good strategy. Moreover, it falls historically. I don’t know upon what piece of ground you stand, but whatever piece it is, it was gotten by war or theft. If Locke is right, there is not a single piece of property with valid title.

Further, is there not a problem in regarding the body as a “property”? To be sure, Our bodies are proper to us, and no one else exercises any natural rights over our bodies. Yet the body is also a gift and a trust, to be returned to its author (or to the soil, if you are of a more naturalistic persuasion) when we have finished with it. If the stories are true, we will again recieve them back, “revised and corrected by the author,” as Benjamin Franklin says, but that is not enough to make them a property.

JPII is right when we are speaking of man-made things, because we can create things from our bodies and from the natural gifts of the land. But when we speak of things that only nature can create, we cannot find a natural principle of division. It seems to be that if the body is a property, then we have ourselves provided a perfect justification for abortion, since no one could have the “right” to invade our bodies, even when we are the agents of the invasion. Or at least, that argument can be made plausible. I have always thought that the “right”-to-life movement argued the question on grounds they cannot win.

Therefore, we can only find that property is a social convention, good when it is socially useful, bad when it is harmful, as in the case of monopoly, etc. As a social convention, we examine it prudentially and pragmatically. I don’t see any other principle that could come into play. But perhaps some others can give me another view.

Mark T. Mitchell

John,

Thanks for bringing Aquinas into the discussion. That’s helpful.

In the liberal tradition, property is often listed as a “natural right.” Locke, as I said, begins with bodily ownership. Are there practical implications for this philosophical foundation? Can we get to a decent theory of property via this route? Or is it likely to derail? Bruce, you quoted Locke in a previous comment. What say you?

John Médaille

Mark, property is a social relation. According to St. Thomas, it is a prudential arrangement in service of the Universal Destination of Goods. Pragmatically, things work better when everybody has their own bit of property to take care of. Therefore the division of property is not based on natural law, but on prudence. As St. Thomas says, private property is not part of the natural law, but a human addition to it. Therefore, it cannot be reduced to some inherent justification. Property arrangements dictate the outcome of all other economic relationships. So we judge property relations based on the kinds of outcomes we wish to see.

Mark T. Mitchell

Locke’s theory of property begins with the notion that a man owns his own body. Is a person’s body properly understood as his property? Are bodies analogous to land and cars and hammers? Can a Christian accept this Lockean notion of bodily property? I don’t see this line of argument in the distributists. But the Austrian School of Economics, I believe, begins with this claim. If the Lockean argument is objectionable, what is the alternative?

John Médaille

Actually, I exclude intellectual “property,” because it is of a different kind and character from real or movable property, so much so that it’s status as property is questionable. Land in general demands exclusive use; if I farm this property, you cannot, lest their be lots of chaos and no produce. But intellectual property grows from common use. The more a good idea is in general currency, the more currency it generates. Thankfully, the computer largely escaped patent, otherwise there would be few of them at high prices. But because the idea is in such general use, it generates lots of wealth. (There was, some 25 or 30 years ago, a suit by Remington against IBM for patent infringement for the computer itself. The court held that Remington had in fact taken the ideas developed by others, namely John Atanasoff and Clifford Berry with their ABC computer. Good thing too. Had they won, we might not be having this conversation.)

Locke was so concerned with property because the “Glorious Revolution” was about property, and specifically about the change in property systems that had taken place in 1535, with the seizure of the monasteries, but wasn’t codified into law until 1677 as the “statute of frauds,” largely as a result of the revolution. The title of the legislation was somewhat of a joke, since the whole land system had become a fraud. Locke had made his money in the East Africa Company, whose only “product” was slaves. His fortune had nothing to do with his labor, but he was careful in his treatise to note that one’s labor or the labor of one’s slaves gave title to property. He said nothing about seizing it from the Church.

We still retain the pre-revolutionary titles to property, but we have changed their meanings. We still hold land in fee simple title, but that does not mean what it did when we had fiefs. To hold a fief was merely to get a fee in return for services provided to the property, such as improvements and courts of low justice. Now it means the opposite, an allodium, a rent for providing nothing but access to the property.

The purpose of property is to ensure that labor receives its reward. If a man works his own land with his own tools, he owes nothing to anyone and no one justly claims any part of his work. But if he rents the land, the landlord claims all values over subsistence.

Bruce Smith

John Médaille makes a good point in saying we have lost the knowledge of what property is for. I will take it that he means all types of property, including intellectual and not just land and buildings.

I believe that you have to go back to rights in order to start understanding property. The rights that we have in society are I believe socially derived and relate to the type of thinking predominating in the society of the time. James George Fraser, the anthropologist, in his classic book “The Golden Bough.” argues from his study of human societies that they have gone through three stages of thinking so far.

The first stage is the age of magic where man believes in a certain established order of nature on which he can always count and which he can manipulate for his own ends. Then he discovers that this is all imaginary thinking on his part. The second stage of discovery, therefore, is that nature is variable and not susceptible to his manipulation and lacking understanding as to why this should be he throws himself on the mercy of a great invisible being, or beings, behind the veil of nature. He makes use of religion. In his current stage, he has acquired the scientific method of empiricism to provide explanation.

In the last analysis though magic, religion and science are nothing but theories of thought, or hypotheses. So when I say our rights are socially derived I am saying they relate back to the line of thinking and hypotheses of the time. For example, with regard to property Fraser in the “Golden Bough.” talks about the Taboo and Sanction system in Polynesian societies whereby the breaking of a taboo can be met by friends and neighbors exercising a sanction of seizing a man’s property. Property is thus not sacrosanct, or an embedded right, since it is subject to the higher order of belief in animistic religion.

In the eighteenth century there is another curious example. This is related to our not knowing why the founding father, Thomas Jefferson, used the phrase “and the pursuit of happiness” in the American Declaration of Independence instead of Life, Liberty and Estate or Property. None of Jefferson’s writings provide a clue. I would artificially and mischievously like to suggest why to illustrate my point that theories and hypotheses are extremely contingent. It is known from Jefferson’s writings that he hero worshipped the English philosopher John Locke and that much of the Declaration of Independence contains ideas from Locke. In his “Two Treatises of Government.” (Which is greatly about property rights) Locke uses the following phrases:-

Sec 59. “…..without any dominion left in the father over the life, liberty, or estate of his son,….”

Sec 87. “Man… hath by nature a power …. to preserve his property – that is, his life, liberty, and estate – against the injuries and attempts of other men.”

Locke had the theory that you owned your own property in yourself and if you mixed your labor with that of an undeveloped piece of land, or property, you were entitled to own that property because you had mixed part of yourself in it. He had a proviso though that your acquisition must leave enough and as good in common for the use of others. Jefferson could buy into that because there was so much undeveloped land in the New World around him. However, Jefferson owned property in the form of slaves and it would seem “highly probable” according to the Monticello website DNA analysis report that he had decided to put some of “his labor” into one of his slaves, Sally Hemings, and father at least one if not six children. Jefferson died deeply in debt and his estate and possessions had to be sold but notably in his will, despite his professed claim to be against slavery, the only slaves he freed posthumously from amongst all of his slaves were Sally Heming’s children. Accordingly could the choice of the phrase “and the pursuit of happiness” instead of Locke’s “estate” or “property” perhaps reflects the Libertarian Jefferson’s inner conflict and acknowledgment of the contingency of Locke’s whole “Property” argument when it came to his child, or children? Or maybe it was simply the case that he just didn’t want further attention and embarrassment on the issue of his paternity! Certainly on the basis of his idea of the property owning consequences of putting your labor into your job then Locke was an early fore-runner and advocate of Distributivism and so was Jefferson in letting Sally’s children “own” their lives!

Finally, an up-to-date example of the societal contingency of property rights is the current patent law in the United States which limits the monopoly usage of a man’s invention to twenty years. His intellectual property is not his own to keep for the rest of his life because society wants to benefit from ingenuity but not be exploited by monopolization.

In conclusion a system of “elite” capitalism is always going to be divisive with the creation of two classes constantly struggling between themselves over the share-out of profits with government subject to “capture” usually by the “fat-cats” to attempt to influence the outcome. This is a massive nonsense when consideration is given to maintaining demand in the economy. In real wage terms there has been decline over the last thirty years but demand was maintained through credit which as we know helped lead to the problems we currently confront. “Plural” capitalism, therefore, in the form of re-distribution of business ownership and decision making is a contingent societal change in property rights that this country badly needs. Those opposed to such change are now going to have to work extra hard to re-think their “taboos” and “sanctions” on changing property rights in the light of Wall Street’s performance!

Sean S.

Someone up above mentioned “worker controlled factories”. The call for direct worker control of production, as opposed through a separated planning apparatus, is something thats been a hallmark of the libertarian Marxists for years, and something which has inevitably played itself out in every Communist revolution, where those who believe in command, centrally planned (and hence centrally controlled) economies go to war against those more interested in vesting control into the people who actually run the place. In a world of complex technological devices, it would be the kind of stop-gap to maintain both industrial capacity and the concept of ownership.

I recommend The Take, a movie by Naomi Klein, about the occupation and restarting of factories in Argentina after their economic collapse, as well Zanon, a documentary about the occupation of the once jewel of the Argentinean state, the ultra-modern ceramics factory of Zanon. Both are interesting explorations of what happens when people, abandoned by a brutal globalised capitalism, decide to do things themselves.

micah

maybe somebody already made this point, but i think the most ironic here is in the attempt “to give the Treasury secretary unprecedented powers to initiate the seizure of non-bank financial companies, such as large insurers, investment firms and hedge funds, whose collapse would damage the broader economy” that they’re using the same open ended language that got W. into trouble when he spoke about the threat of terrorism to national security, and therefore the extreme measures that must be taken. i do believe these guys are all genuine in their belief that we must sustain the system and that these are the only measures left. and at that point, we’ve already lost the game, because the values system has shifted from real values to sustaining the system. and to do so, open ended threats are used to support open ended power.

Josh Cooney

I can’t blame everything on education but the social engineering program instituted by Dewey and his Apostles has, as far as I can tell, produced several generations of Americans who cannot recognize basic and obvious propaganda. The system has served the government and big business well. And those are the two main sources of funding for education.

Before I’m ready to sign up for any more public funding of schools, I need to see a radical shift in both teaching methods and content. Even if I can’t have my utopian classical-Christian curriculum, I would like students to be demonstrate competence in logic, grammar, composition, memorize the Bill of Rights, and be saturated in good sound imaginitive literature from Shakespeare to Robert Frost.

I break the rules of logic–and unfortunately grammar too–all the time, but I have noticed since I took a course in logic that almost every single argument made by politicians and pundits today could be declared invalid on logical grounds. (The most common fallacy is special pleading.) If students had a basic understanding of language and logic, and recited the Bill of Rights before school instead of the Pledge to the Federal Government, then we’d have a fightin’ chance for liberty in our lifetime.

John Médaille

Brett, I agree about education. That’s what I meant when I said that the state should not be the monopoly supplier. It should fund, but not necessarily supply the education. I also agree that the battle over centralization goes back to the founding itself. Nevertheless, the battle is essentially over with the passage of the 16th amendment. After that, the centralizing tendency will become like the Borg: “Resistance is futile.” Now, there is no check on the federal gov’t in any meaningful sense, and the funding question will settle every dispute.

Josh, I think there has to be some standard of education in a unified country. Are you blaming on education things that can be properly assigned to other cultural forces? In other words, is the educational system the cause or the effect?

As for the standards debate, should some students be educated in English, others in Spanish, still others in Arabic, Hebrew, Hindi, or Vietnamese? That’s a recipe for civil strife, is it not? I don’t mean that there is no diversity; a diverse society needs a diversity of educational systems. And I have no objection the Madrassa teaching Arabic if only their students are also proficient in English.

And homeschooling ought to be supported with funds, since all education is the responsibility of the family; we farm the job out to schools, but that does not relieve us of the responsibility. Hence all genuine schooling is, in some sense, home schooling.

Josh Cooney

I’m skeptical that public funding does not lead to a monopoly of ideas. I attend a Catholic college that receives state and federal subsidies, and the education is indistinguishable from the Stalinist SUNY system.

Who gets to standardize education and why is this such a necessity? Would this apply to homeschoolers and private schools?

We need to have a clearer idea of the purpose of an education. I would like a system that can produce men like John Randolph of Roanoke, T.S. Eliot, and Russell Kirk. I doubt a standardized public system will do this. And for the rest of us who desire a true education, yet lack the creative intelligence of those men, we ought to have the opportunity to receive a basic education in classical and Christian culture. But I doubt the American public would fund something that is not career or vocation based.

Beyond that, I think it might be best left up to families, and philanthropic, community, and Church organizations to educate their young as they see fit. I would really need some convincing that standardization, which is very different from having high standards, is a good thing.

Brett Beemer

John,

I agree that a diverse source of education is nice but for the majority of people education has a single source. That education system is now controlled by “No child left behind” because there are no longer enough tax revenues for the school system in the states for them to ignore this. Education has become centralized by the federal government.

As for centralization, I believe we can go back farther than 1913 or the civil war. It started when they scraped the Articles of Confederation for the US Constitution. It was made more expansive when Jefferson (yes that T. Jefferson) bought the Louisiana Purchase. It was made even more expansive when territories were told how to divide up the land inside them. I am not saying that we do not need some centralization but the natural shift is for people with power to consolidate and then expand that power. The process was begun even as this country formed. (I did not even mention Hamilton’s Federal system).

John Médaille

Brett, two comments. On education, it must be a community effort, and at least somewhat standardized. That is, the community (in our case, the state) ought to fund it and in some way to govern it. However, funding it and being the monopoly supplier of education need not be the same thing. I do not believe in a “free market” in education; all the wrong things are likely to have market power. Nevertheless, a diverse society can benefit from a diversity of educational sources and approaches.

Centralization is really a different issue. I think the decisive moment was not so much the Civil War as the 16th Amendment to the Constitution (1913). When the federal gov’t acquired the power to tax incomes, it became the largest funding source for all public purposes. Power follows the money. With the passage of the 16th amendment, the rest of the constitution became more or less irrelevant, its clauses easily overridden when convenient for the sake of getting the necessary funding. It is a sad state of affairs when a candidate for vice-president (Joe Biden) can boast that as a Senator, he “put 11,000 cops on the beat.” As a former city councilman, I thought that was my job. Now even mundane local functions are kicked up to the highest level of government.

Brett Beemer

The issue that seems to me that many are mentioning here is not so much property but societies understanding of its need for property (which includes craftsmen). John M’s comment “Men have not so much lost their sentiment for property as they have lost the knowledge of what it is.” I think sums that thought up clearly enough.

But what do we expect when government controls how people think by controlling the education system. Is it any small wonder that most people think that the Federal Government should control more as that is what they are taught in schools. To teach anything differently risks those important Federal education dollars. When you allow the master to control what you think then there is no real need to think and we all become servile. To question authority is to risk repercussions.

It amazes me today that no one ever mentions that we are really a collection of States which at one time meant separate countries. The US has been on a centralization trend since the Revolution ended. To turn the tide back you would need to educate people what used to be. And to do that you would need to remove the limit on what is taught in schools. Unfortunately I am sure that would lead to law suits regarding what is taught.

The basis for the future is usually what is taught in schools or training. Very rarely is society that much different than what is taught.

Josh Cooney

Once again, I apologize for my negative tone and hyperbolic rhetoric in previous posts. It is neither helpful nor nice. All I can say in my defense is that I am the last of a long line of hot headed Irish Cooneys. In any case, here are some thoughts that might be useful to the discussion of property.

1)Chesterton’s linkage of property and liberty is not exactly that of Jefferson who viewed property as a means for political independence. Chesterton agrees with Jefferson on this point, I think, but moves beyond politics into something more fundamental. Chesterton’s idea of property has more to do with Man fulfilling his nature, or so it seems to me. Inside the home there is adventure, creativity, love, and kingship. And when Chesterton says that “Property is the art of the Democracy,” the emphasis is on the word “art,” at least as much as it is on Democracy. A home, says Chesterton, a man can “shape in his own image, as he is shaped in the image of heaven.” It is in the home that we can be both artist and king. Perhaps the modern world has made obsolete property’s Jeffersonian meaning of economic and political independence. But I doubt it has totally eliminated the Chestertonian meaning.

2) We sometimes speak as if the concept of the yeoman farmer and the craftsman are mythical figures who either never existed or have been extinct since the demise of the woolly mammoth. It wasn’t that long ago that America was filled with such characters. Moreover, there are more small farmers now than there were in 1990 and though I doubt there are as many craftsman as in past years, there are plenty of people who are skilled woodworkers, carpenters, plumbers, contracters, and others who own their own tools and work for themselves or a small family owned business. I’m sure there are many folks who if they had the tools and training would love to own a business or even make products for a side income. My father, for example, is currently trying to start up a custom guitar making enterprise.

So, I guess, I’m not so sure I accept the premise that the Jeffersonian and Chestertonian concepts of property are dead.

John Médaille

Men have not so much lost their sentiment for property as they have lost the knowledge of what it is. The question has not been important because the corporate state has taken care of us so well. It really has, up until the 80’s, when the whole thing started to slowly come apart.

Men will rediscover property as the state fails; we will be forced back to our own resources, and the primary resource–indeed the primary economic relationship–is property.

Josh Cooney

I should have said, “Your question about property…not “You’re”

Josh Cooney

1) Socialism is incompatible with Christian teaching, therefore, as far as I am concerned, it is not an option. This does not mean, however, that Christianity itself cannot survive in a socialist society.

2)Without the New Deal the American Empire and the perpetual war machine could not exist. The same principle is true for Lincoln’s War and Wilson’s War. Without increased federal revenue stolen from taxpayers, those illegal and destructive murder campaigns could not have happened. Neither could Korea, Vietnam, the Cold War, Iraq I, Serbia, Afghanistan, Iraq II. Even the leftist Edmund Wilson understood that it was through government taxation and centralized federal power that the U.S. could perpetually threaten life across the globe. Instead of giving examples where some interests benefited from the fed, let’s stick to the big picture, please.

3)European culture, even now, is in large part a manifestation of centuries of Catholicism and, by extension, subsidiary thinking. Moreover, Europeans have not totally rejected the cultivation of intellectual and aesthetic values. Americans, on the other hand, are crude, pragmatic, and materialistic. Europe can seemingly reject historic Christianity outright and still live much closer to the soil of Christian culture than Americans, who have do not share the same tradition.

4) You’re question about property is a good one. I agree, most people don’t care about property, independence, or the Good Life in general. Malcolm Muggeridge once said that western man had lost his taste for freedom. If we have a servile people then we will get a Servile State. That is why this is a cultural and religious issue, not an economic one. As Russell Kirk truly put it, “All culture arises from religion.”

So, if your question is, since we already live in a partial Servile State, why don’t we just go all the way in?, then my answer is that I do not wish to concede defeat and hand myself over to the State, especially the American State. If wimpy Americans want to continue their soft, frivolous way of life, I can’t stop them. But, please, just leave me alone. Let me farm my land, don’t tax the hell out of me, and stop making the rest of the world angry. In other words, if you must create a socialist society, please let some of us opt out.

Russell Arben Fox

Josh,

Socialism might work in Denmark or Sweden, but do we really want to give our massive bureaucratic, military-industrial, paranoid and corrupt government MORE power?

When you get down to specifics, this question is a bit of a red herring; there are innumerable historic, social, cultural and historical reasons why a social democracy such as has emerged in Scandinavia over the past century couldn’t be replicated in the U.S. But on the level of principle, this is a very good question: is the United States, and its government, simply incompatible with any kind of socialism which is not ultimately a collectivist tyranny? I would tentatively say “no, it is not necessarily incompatible,” but I am prepared to be proved wrong.

I truly and honestly do not understand why Mr. Fox and so many folks on the liberal blogs even consider increasing the power of the Federal Tyranny.

The underlying assumption here is that any increased action by the federal government mitigates against human freedom; in other words, the presumed thesis of the hypothetical question I posed above. As I said, I am persuaded to convinced of the truth of this assumption. But there is much from our own history which works against it. Consider the New Deal–a massive increase in the power of the “federal tyranny,” correct? Well, certainly the farmers who, under Wickard v. Filburn, found themselves restricted by the government in how much they could plant on their own land would agree with that description. But there were also farmers–far more farmers, if you take a look at the election results–who saw the New Deal, with it’s guaranteed bank and loan protections, as great populist increase of their own freedom, in that they could go forward with their business without fearing that their land would be taken away from them (robbing them of the ability to plan for their posterity) if prices fell or banks failed. So, which freedom do we prefer? Which one has more to do with the sovereignty of individuals and communities?

This really just goes back to the same question I’ve been asking throughout this thread: when “property” in the Chestertonian sense is foreign to the lives of the great majority of the urban and suburban dwellers of this country, what is the relevance of his argument about freedom? I’m quite sincere in asking this. What exactly is the character of the “Servile State” in a world of credit cards, second mortgages, college loans, retirement funds, and the like? Does the nature of finance capitalism not really change anything, or would distributism have look different in 21st-century America?

Should I simply ignore the fact that all socialist governments that I know of are radically anti-Christian?

As for this, Josh, I think Front Porch’s own Patrick Deneen would, if not completely disagree with you, than at least issue some serious caveats to your claim.

Josh Cooney

I apologize for my angry tone. And I think I am probably reaching conclusions about Mr. Fox’s comments that he did not intend. I do, however, find it very difficult to accept any proposal that gives the federal government more power.

Josh Cooney

Not socialistic enough?

Socialism might work in Denmark or Sweden, but do we really want to give our massive bureaucratic, military-industrial, paranoid and corrupt government MORE power?

I truly and honestly do not understand why Mr. Fox and so many folks on the liberal blogs even consider increasing the power of the Federal Tyranny.

There is a strange, perhaps not so strange, convergence of thought between Neoconservatives who believe we must give the Federal Tyranny unlimited power in the name of national security in the War on Terror, and Socialists who think we should give the Federal Tyranny unlimited power over the economy in the name of national security, because “it’s too big to fail.”

I don’t like Wall Street and Walmart but neither can steal my money or property by the use of force or threat of imprisonment. Neither can steal my money in order to bomb innocent people in far away deserts and jungles. And neither can take my children–should I have them–and send them to die in far away deserts and jungles, nor can they tell me how to raise and educate my kids–again, should I have them.

Should I simply ignore the fact that all socialist governments that I know of are radically anti-Christian?

Are any of Obama’s policies authorized by the Constitution?

What does Mr. Fox say to people who want to get out of the system? In your socialist nightmare, will I be allowed to live off my own land? Or will I experience government interference and, possibly, the confiscation of my property (including abusive taxes) in order to fund the socialist nightmare?

D.W. Sabin

What is interesting about the Ownership Society of President Bush, a continuation of a Clinton policy…. is that under Bush, the securitization of debt opened the door to the non-verification, unsecured mortgages (or vice versa) that allowed people to buy homes and “own” property beyond stocks. Needless to say, it was a shell game where the consumer was habituated to think of that property not only as a home…or forum for family life but more importantly , a type of Stock more important for it’s power in the financialized economy than in the classic sense of a property compounded under stewardship and tangible value. The home “owner” was less an owner than a “sharecropper” in a monocultural industrialized finance. The farce succeeds because it fulfills outward desires for ownership and stewardship without diluting the consolidation of perceived value enjoyed by the Financial system…..until now, when the lack of security pulled the curtain back.

Property ownership remains a powerful focus for the culture and one hopes that it will not take catastrophe to reinstate it within a more productive system. With the binary system evolving now…profits are private and debt socialized, the prospects are dim at best for the larger part of society.

Bob Cheeks

Mr. Mitchell, thanks for an excellent piece.

We might consider that because we co-exist in a society that in large measure is dominated by “epigonic Marxists” it will be extremely difficult to escape the horrors of the “second realities” about to be imposed by the Obama regime.

If we have learned anything of the human condition it is that there exists a movement in the tension of existence, one sense of which is expressed in a passage from Plotinus’ Enneads on tolma, “…Well the origin of the evil for them was restlessness becoming primordial otherness and the will to belong to themselves…and having reached a far distance, they no longer know from where the have come, like children who, taken away from their father and brought up a long time far from him, no longer know themselves or their father.”

The good news is that history shows us that there is always, at some time, a countermovement, the awakening of the soul and the turning toward the divine ground. I fear it will be a long time coming.

John Médaille

Could there be a silver lining around the cloud of this crisis? Or could this merely grease the rails for a more virulent statism?

Both. The later and then, hopefully, the former. Will the center hold when it has lost all credibility? Only by force. Will it have enough force? I hope not. We need to build local institutions. Farms, schools, skills, local trading. Planting a tomato is an act of resistance. These will be forced on us by circumstances. If we respond properly, we could build a workable society, perhaps even a pleasant and prosperous one. If not, there will be a new dark age. And a technologically enhanced dark age at that.

Or maybe something else entirely will happen.

Mark T. Mitchell

John,

Thanks for these distinctions. The obvious question: how can property be restored once the taste for it has been lost? You hint that our current economic troubles might force a return. Could there be a silver lining around the cloud of this crisis? Or could this merely grease the rails for a more virulent statism?

John Médaille

Mark, Belloc recognized that property needed a political consensus, and that people were out of the “habit” of property. Indeed, they don’t even know what it is. Bush talked about “the ownership society,” but only meant buying a few shares of stock with your social security money. Real ownership of the means of production, ownership each of us could use to make our own way in the world, by ourselves or with our neighbors, is simply unknown to the mass of men. This would seem to work against a political consensus. BUT, the old, or should I say, “current,” forms of ownership are becoming worthless. Further, the state itself has been and will be discredited. People will be forced back to the own resources, and they will discover resources they never imagined were there.

To your other questions, the wage is a result of property. If it is the result of your use of somebody else’s property, you will get only a portion of your wages. Hence, property is more conducive to freedom. The question on freedom is crucial. The Miseans claim to be about “freedom,” but they mean the term only in the formal sense, that is, being undetermined with respect to possible courses of action. If a man is free to choose any course of action he likes, then he is “free.” Thus Novak can say that under capitalism, “Every vice must be allowed to flourish.” Belloc is using the more Christian view of freedom, which is directed towards truth.

For example, the choice to take your cocaine in crystal or powder form is “freedom” in Novak’s sense, but slavery in Belloc’s, because either choice, free though it might be, leads to slavery. For Belloc, freedom has both a formal and material aspect. The “freedom” to acquire unlimited amounts of property can be formal freedom, but not material freedom, since a fixed asset can only be occupied by denying others the same right. One man’s unlimited right is therefore everybody else’s slavery.

Russell Arben Fox

Further, is there a difference between property and wages?

Or, as I essentially asked my above comment, between property and credit ratings? In the world of finance capitalism, it is the latter upon which most people depend. Following John Médaille, I honestly wonder: what does Belloc’s message tell us about those who inhabit–and govern their lives through–the turbo-changed capitalist state of 21st-century America…namely, just about everyone reading this comment?

Mark T. Mitchell

Brett,

I am not suggesting everyone return to the farm. I am suggesting that real property is a bulwark for freedom. Skilled craftsmen, who own the tools of their trade, are not farmers. On a larger scale, worker-owned factories should be explored.

Here are a few questions we should put to Belloc: Is there a connection between property and freedom? Further, is there a difference between property and wages? Is one more conducive to freedom? Finally, what, exactly, is freedom, in Belloc’s sense of the term?

Mark T. Mitchell

Belloc believed that government had created the mess and that the power of government needed to be harnessed to help fix it. He thought that one of the most effective means to achieving a distributist state was through a tax code that encouraged small property-owners and discouraged the consolidation of property. The problems are obvious: 1) this requires a political consensus about the desirability of a propertied state and 2) it trusts the state to implement this wisely. This makes me nervous. Are there other routes to the same end?

Brett Beemer

Mark,

I agree that it looks as if I am looking for a permanent solution which may not be possible in this world. On the other hand why would a person change from something that is broken but the problems are known to a system from the past but we as a society (other than a small few) are ill equipped to survive in unless that solution is permanent? Especially if that system leads to where we are today?

Most people today are not educated on finances or on property as understood from your blog. Most only understand they go work for someone to get the things they want. Most are comfortable with this and do not see a need for an agrarian Jeffersonian society as they do not see their place in it because of their limited knowledge. Unless they see how it benefits themselves and possibly their children they will not move to the unknown (which for most people is their greatest fear). People want known stability hence their drive for collectivization.

I am sure that I am misunderstanding something other than you are just turning the clock back farther away from collectivization but that the future will again move forward towards collectivization. All we are doing is making life good for us but not improving that of our children (or great great grand children as the case may be).

I will steal Mark Shiffman’s analogy about education and use it here. Am I a fool because I believe that there is something more we can be than the watchers, engineers and the designers of the show? Should we settle for “it cannot be done” so let’s just do what is best for ourselves today? I agree we should move forward with what is best for society as a whole but I think we should also try to find a permanent solution if one exists. Mankind in the future will probably destroy the solution but at least we tried.

D.W. Sabin

Although the great assembly liners have done their level best to create the perfectly engineered tomato, they aint quite yet created a Fiat Tomato and for this we can be justly happy.

The greatest threat to decentralization remains centralization’s darkest spawn…the Standing Armies of the Nation State, their terrorist antipodes and the ever churning market of the tools of death . Until there is recognition of the organized effort to stuff the planet into a coffin, we will remain distracted from exploring the way out of our prolonged engagement with clanking a chrome plated barrel across our thick skulls.

Fear and a disregard of life is waterboarding us all.

John Médaille

Mark, I would read the history somewhat differently. Belloc’s Servile State got here in the 30’s and the 40’s. And it worked as well as Belloc thought it would, at least through the 70’s. It guaranteed security of capital on the one hand and the welfare, more or less, of the worker on the other. But since the 80’s, the system has been under severe strain. What we are witnessing is not the arrival of the servile state, but its collapse. The SS can no longer guarantee either capital or labor, and hence it will fall under pressure from both. The capitalists are looting the store on the way out the door, but the loot may not be worth anything.

As the system collapses, each community will be thrown back on its own resources, and they will discover that they have an enormous amount of resources. Distributism will rise naturally and organically from the rubble. This is not a given, of course. Russia, and most of the other communist states, went quickly to capitalism, but that is working for them about as well as it is working for us. What we really need now are well-trained agrarians, distributists, mutualists, cooperativists, etc., who can rebuild the world.

Empedocles

It seems that the conservatives who claim that the government should stay out of business get stuck between needing the government to intervene in order to break up businesses that are “too big to fail” or they must intervene to bail them out once they do fail. In either case the government ends up intervening. As they say, too big to fail means to big to exist. Instead Obama and Geittner are going to do the worst of all possibilities, allow giant businesses but manage their affairs. Where’s Teddy R. when you need him?

Russell Arben Fox

Mark,

A sincere question, from one who mostly believes the primary problem with the proposals of Obama, Geithner, et al, is not that they are potentially socialistic, but rather that they are not socialistic enough…

Does the fact that the United States currently exists in the socio-economic world of finance capitalism make any difference here? For the collectivization currently taking place does not, in fact, involve land or property or merchandise; it involves mortgage debts, stock options, credit allowances, investment portfolios, and the like. Now, maybe the principle still holds; if these financial instruments are the way in which working men and women protect their livelihood–buying up factory space, meeting paychecks, supplying store shelves, etc.–then it really may be the case that a government program to assume control over them is a limitation upon their freedom. I’m not sure that is the case, however; it is possible that we are so far removed from an environment of economic life involved being a producer of actual material things that Chesterton’s basic assumptions about the relationship between economic security and political freedom no long apply. But I will wait for someone more knowledgeable in distributism than I to answer.

(As a p.s., though, I must note that Obama’s bank rescue plan does not, in fact, call for the nationalization of banks and the collectivization of these securities; rather, it calls for an investment in private stock managers to buy them up at hopefully competitive prices, to try to get credit markets working again. And frankly, given the record of Wall St., I’d rather have the government be a direct owner, than a welfare agency to hedge fund operators…)

Mark T. Mitchell

Brett,

I detect in your question here and in other posts a desire for a permanent solution to our vexing troubles. There are none. Perfect solutions are for another world. We must seek to understand our particular problems and, using reason and experience, do our best to avoid catastrophe and perhaps make modest improvements. That, I think, is the best we can expect. This is not pessimistic, because I think improvements can be made and disaster can be averted, and we at the same time provide an example to future generations. We must do our best to act responsibly in the time we have been given. Demanding more is to demand that the world be other than it is. This is a natural temptation but one that must be put aside.

Mark

Brett Beemer

Mark,

A well stated response to what Obama has asks for. I might disagree a little with you that collectivization provides security. It may for short time but in time those who help lead the efforts of the collectivization will take away the security of those who disagree as a need to protect society. As freedom goes away it’s sister security for most citizens will follow in less than a generation. Ben Franklin’s quote “They who can give up essential liberty to obtain a little temporary safety, deserve neither liberty nor safety.”

Knowing that collectivization is an evil that we are heading for is how do we restart the path to capitalism that does not lead to corporate capitalism that ends with collectivism? It seems that no matter how we get back to the private property as described above it will eventually lead to the same problem again. Where or better yet what is the permenant solution?

Comments are closed.