The forgettable State of the Union speech occupied the press a few news cycles, and its place was quickly taken by the new budget, a document which has a certain entertainment value of its own. But the really significant thing that happened caused only minor comment: it was that Ben Bernanke was reappointed. This did gather some brief commentary because there were a total of 30 votes against him, an unprecedented number when dealing with a Fed Chairman. This raises the question of why the congress should be so kind to Fed chairmen in general, and this Chairman in particular. In a town were everything is contentious, and in a Senate where everything requires a super-majority but nothing gets it, the re-appointment got it with room to spare.

The forgettable State of the Union speech occupied the press a few news cycles, and its place was quickly taken by the new budget, a document which has a certain entertainment value of its own. But the really significant thing that happened caused only minor comment: it was that Ben Bernanke was reappointed. This did gather some brief commentary because there were a total of 30 votes against him, an unprecedented number when dealing with a Fed Chairman. This raises the question of why the congress should be so kind to Fed chairmen in general, and this Chairman in particular. In a town were everything is contentious, and in a Senate where everything requires a super-majority but nothing gets it, the re-appointment got it with room to spare.

The President who promised change could not even change the Chairman, not even one who had failed so badly, and who continues to fail. The Senate for its part admitted that they were united in one thing only: their cluelessness on economic policy. Because the Fed provides the reserves to the banks, and because the banks provide credit to the economy, and because the economy cannot function without credit, the Fed is the most important institution in the economic life of the country, arguably more important than the Congress or the President. Yet both have been reluctant to control the Fed. This is not new. Banking and credit is supposed to be a “technical” matter, best left to the technicians and isolated from the politicians. This means that in our democracy, the democratic institutions have little control over the institution that makes the most difference in the economic life of the country.

The same problem has afflicted presidents back to Carter, at least. They felt they were not able to confront the Fed Chairmen. Volcker single-handedly wrecked the Carter administration, and nearly did the same to Reagan, until the White House finally found the guts to get him to stop. Both Volcker and Bernanke are Monetarists, who believe (believed, in Volcker’s case) that money problems could be cured with by controlling the money supply. Volcker tried to cure inflation and Bernanke deflation using the same philosophy, and both failed. Volcker raised the fed funds rate to 20% in an effort to reign in lending; it failed. Bernanke has created unimaginable piles of money to get banks to start lending again, and he has failed. You would think by now that Monetarism would be thoroughly discredited. But Bernanke got 70 votes.

Without making substantial changes at the Fed, there is little change that Obama—or the congress—can make. But then Obama has found that he has little enough room for maneuver. The Senate requires a super majority which he cannot command, the Fed is out of his control, and the Supreme Court has formally turned the political process over to the plutocrats. He has nowhere to go and nothing to do, save have lunch with Pelosi and fly about the country in Air Force one. He has the trappings of power, but none of the substance. He can make speeches about bipartisanship, but he knows that no one is listening. His own base has abandoned him, and his administration seems clueless about the crises.

The new budget is a sign of his impotence. He boldly proclaims an austerity program, which turns out to concern at best the 17% of the budget that is deemed “discretionary.” At what point, we may ask, did the bulk of our budget escape our control? But it has certainly escaped Obama’s, and he hasn’t a means to take the reins of power. The Democratic Party has proven a weak support at best; even with majorities larger than any that Bush or Reagan could command, they have not been able to impose their will upon the country, for the simple reason that they have no will. As Paul Craig Roberts noted,

Obama and the Democrats cannot be an opposition party, because Democrats are as dependent as Republicans on corporate interest groups for campaign funding.

The Democrats have to support war and the police state if they want funding from the military/security complex. They have to make the health care bill into a subsidy for private insurance if they want funding from the insurance companies. They have to abandon the American people for the rich banksters if they want funding from the financial lobby.

Now that the five Republicans on the Supreme Court have overturned decades of U.S. law and given corporations the ability to buy every American election, Democrats and Republicans can be nothing but pawns for a plutocracy.

Most Americans are hard pressed, but the corporations have only begun to milk them.

So far, the President has nothing to show for his tenure but a failed stimulus and an empty Peace Prize. The recent job numbers were revised to show that the economy lost 1.2 million more jobs than was previously thought. And the unemployment lines are getting longer, not shorter. That the stimulus has failed must come as a great surprise to his economic team, since stimulus has generally worked in the past. However, that past was one in which we made more of the goods that we consume. In an economy that imports so much, much of the stimulus leaks off-shore. If stimulus was going to work, it would have worked for Bush, who ran up $6 trillion in debts, but all we got for that was two wars and a housing bubble.

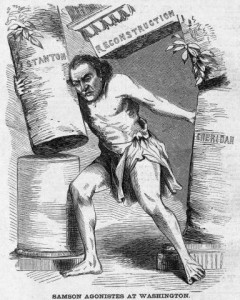

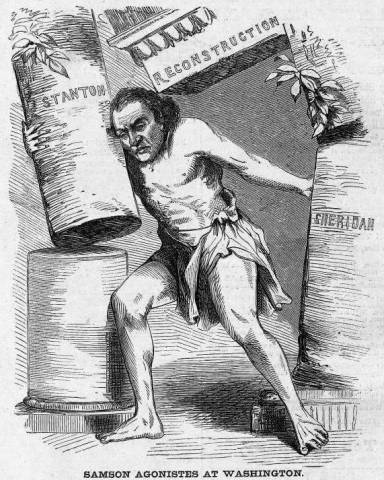

Obama came to Washington as a Samson, ready to do battle with the Philistines who controlled all the levers of power. Or so his supporters imagined. They invested all their hope in him as a person capable of rousing the Democrats to battle and the country to real change. Yet, instead of doing battle with the Philistines, he invited them into his cabinet, he gave them what they already had. It is possible, I believe, to locate the precise moment when Obama failed: it was the moment that he appointed Timothy Geithner and Larry Summers to head his economic team. These men have their fingerprints all over the crash, Summers by being a strong advocate of financial deregulation and Geithner as the primary engineer of the AIG bailout. This is to say that Obama stacked the deck against himself even before he took office. He abandoned the change he had promised to embrace the policies of his predecessors. I’m pretty sure he didn’t see it like that; he thought that these were technical matters and he got the best technicians he could. Indeed, this is probably the best set of resumes ever to serve in government, but their skills are in all the wrong areas; they are trying to solve the problem with the tools that created it. Obama has no workable economic plan; he can only hope that the recession runs its course. But this is unlikely.

Nor will he get much help from the Republicans. One, they don’t have any plans of their own, and two, they understand that their success depends upon his failure. There is simply no incentive for cooperation. As the economy sinks, their fortunes will rise; they expect, not without reason, a sweeping victory this year and a return to power in 2012. But when President Palin, or Brown, or Cheney, or Jindal takes office, he or she will find that power ain’t what it used to be. They will be in a somewhat better position than Obama, since they will be able to command super-majorities in the Senate based on blue-dog Democrats, or else they will simply ignore the rules. But lacking any plans, they will not have much they can do. They will get some income and corporate tax decreases and some payroll tax increases; they will find new privileges for the powerful and new subsidies for the rich. In return, they will receive endless benefits and lifelong employment. And their campaign coffers will never run dry.

I cannot recall a president who has made himself so irrelevant so quickly, one who so easily took a haircut. He lacks a base, he lacks a party, he lacks a program. It will be interesting to see how Obama responds to his own impotence, to the realization that he is the prisoner of powers he cannot control, powers he himself invited into his administration. Samson became the laughingstock of his captors, but found the strength to pull the whole wicked structure down upon both himself and his enemies. The best Obama can propose is to appoint a commission to study the problems, a commission that will, no doubt, consist largely of the Philistines. This will not move the pillars of power very much, but it will amuse the Philistines.

Obama’s accomplishments will be limited to things like “don’t ask, don’t tell.” On other issues, he will be a mere observer, like everyone else. The real rulers of the land, represented by Geithner and Bernanke will continue to loot the country, until there is no country left to loot. Unless something changes, he is likely to be a one-term President who will leave office with a Peace Prize and a wrecked economy. And gays in the military.

40 comments

Gregory Morales

oh and by the way – “Global Credit Economy” which outlike the creation of credit and how it gained value, as well as the Credit Economy formula which is still the model for all first world economies if the whole focus of that work – not just a few words taken out of context.

Gregory Morales

Here is some stuf I wrote about Credit Expansion based economies back in 2008, I’ve been writing about Creditism and the Global Credit Economy for some 10 years now. http://newsweek.washingtonpost.com/postglobal/2008/11/what_countries_will_recession/comments.html

have a nice day

Bruce Smith

Here is Wikipedia outlining the ideas used by Richard Werner under the “quantitative easing” term he preferred to use instead of “credit creation” :-

“The earliest written record of the phrase and concept of “quantitative easing” has been attributed to the economist Dr Richard Werner, Professor of International Banking at the School of Management, University of Southampton (UK). At the time working as chief economist of Jardine Fleming Securities (Asia) Ltd in Tokyo, and noted for his 1991 warning of the coming collapse of the Japanese banking system and economy (reference: Richard A. Werner, 1991, The Great Yen Illusion: Japanese foreign investment and the role of land related credit creation, Oxford Institute of Economics and Statistics Discussion Paper Series no. 129), he coined the expression in an article published on 2 September 1995 in the Nihon Keizai Shinbun (Nikkei) (reference: Richard Werner, Keizai Kyoshitsu: Keiki kaifuku, ryoteiki kinyu kanwa kara, Nikkei, 2 September 1995;

According to its author, he used this phrase in order to propose a new form of monetary stimulation policy by the central bank that relied neither on interest rate reductions (which Werner claimed in his Nikkei article would be ineffective) nor on the conventional monetarist policy prescription of expanding the money supply (e.g. through ‘printing money’, expanding high powered money, expanding bank reserves or boosting deposit aggregates such as M2+CD – all of which Werner also claimed would be ineffective). Instead, Werner argued, it was necessary and sufficient for an economic recovery to boost ‘credit creation’, through a number of measures. He estimated in this article that the incipient bad debt problem of the Japanese system (i.e. including future bad debts) amounted to about Y100 trillion, or 20% of annual Japanese GDP, and that this had increased banks’ risk aversion. The subsequent slowdown in bank credit extension was the major problem, because commercial banks are the main producers of the money supply, through the process of ‘credit creation’. He thus recommended as a solution policies such as direct purchases of non-performing assets from the banks by the central bank, direct lending to companies and the government by the central bank, purchases of commercial paper (CP) and other debt, as well as equity instruments from companies by the central bank, as well as stopping the issuance of government bonds to fund the public sector borrowing requirement and instead having the government borrow directly from banks through a standard loan contract. All of these, Werner claimed, would stimulate credit creation and hence boost the economy. Many of these policies have recently been adopted by the US Federal Reserve under Chairman Bernanke, who was familiar with the debate on Japanese monetary policy, under the expression ‘credit easing’.

However, while Werner used and explained the concept of ‘credit creation’ in his article, he chose not to use it in the article’s title, as too few readers would be familiar with it and alternative expressions were associated with flawed or failed policy prescriptions. Werner preferred to coin a new phrase. In his subsequent writings, including his bestselling book on the Bank of Japan (‘Princes of the Yen’, M. E. Sharpe, and his 2005 book ‘New Paradigm in Macroeconomics: Solving the Riddle of Japanese Macroeconomic Performance’, Palgrave Macmillan), Werner argues that the Bank of Japan’s usage of his expression ‘quantitative easing’ may be misunderstood. While suggesting it was adopting the policy suggested by a leading critic, the Bank of Japan implemented the standard monetarist expansion of bank reserves and high powered money, which Werner had predicted would fail. It is not obvious why the Bank of Japan chose to use Mr Werner’s expression, and not the already existing and widely used expressions ‘expansion of high powered money’, ‘expansion of bank reserves’ or, simply, ‘money supply expansion’, which more accurately describe its adopted policy at the time.”

What is interesting is that his idea of “purchases of commercial paper (CP) and other debt, as well as equity instruments from companies by the central bank” is close to Tim Congdon’s purchase of government bonds from pension funds, mutual fund and insurance companies. Tim Congdon argues, however, that there is better incentivization from these three organizations to pursue their purpose in life which is to invest in higher yielding investment opportunities than cash on deposit. Also interesting is that for a supporter of Margaret Thatcher Tim Congdon wants to make use of a quasi-government vehicle, or at least government sanctioned vehicle, to do the quantitative easing. Finally, for the distributists there is the intriguing idea that this new form of monetary stimulation could be used for purchase of equities via pension funds to achieve more influence for employees in corporation business decisions.

Bruce Smith

One more Tim Congdon article:-

http://www.telegraph.co.uk/finance/comment/6033961/Policy-must-focus-on-a-continuing-positive-rate-of-money-growth.html#comments

Bruce Smith

Thanks Tomas. Here is the Tim Congdon argument:-

http://www.standpointmag.co.uk/node/1577/full

Tomas

Creditism and the idea of a credit expansion economy haven reached it limits was introducted in 2004 at the Global studies Association, California Sociological Association, and the American Sociological Association meetings. Stands to reason, as those papers had to be submitted before 2004, that the kid from SDSU must have come-up with the economic theory sometime before 2004.

Bruce Smith

Albert. I think you’re absolutely right to have these worries. They are really Principal-Agent, or Agency Theory, problems. The only way that I can see to reform the Federal Reserve Bank is for both Congress and the staff of the Bank to have joint responsibility for deciding on the Head of the bank with automatic review every eight years but the ability to change at any time. This would be similar to the mutualist idea the British Conservative party is proposing for public sector services. It is an idea the think-tank director, Phillip Blond, has championed:-

http://www.respublica.org.uk/media/tories-renew-pledge-allow-public-sector-workers-form-co-operatives

and:-

http://www.respublica.org.uk/articles/ownership-state

In addition the constitution of this reformed Federal Reserve Bank would be like a Trust which would task the Head with the job of ensuring there was widespread representation of different economic viewpoints amongst the staff and inductive data analysis research to support those viewpoints. The principal objective is to try to avoid economic theory being based on deductive partisan, or sectional, interests and to attempt to make the economy socially optimal. The reformed Federal Reserve Bank would be tasked with producing an annual statement drawn up with the Treasury setting out the broad macro allocation of credit creation to various GDP and non-GDP sectors. The reformed Federal Reserve Bank would be responsible for the allocation of electronically generated credit through auction to the private banks on the basis of management fee bids. In allocating credit to customers the private banks would also be required to incorporate a percentage of their own capital with each allocation to encourage good allocation judgment. Savings interest would be paid out of credit loan interest as before.

Albert

Bruce, thanks for the explanation. I understand what you call “Credit Creation theory/Creditism.” Werner is among many who have noticed the effects of money creation via bank lending in a fractional reserve system. I’m still wary of the two issues I raised in my previous comment.

I think in theory, you are right that it could be good if federal government elites managed leveraged lending to productive economic sectors. But I don’t think you appreciate the extent to which the federal government is complicit in the errors and avarice of the Big Banks. Summers, Geithner and Paulson are part of the federal government which you believe can manage the lending in America through direct control and regulation. Maybe you’re right in theory. But I doubt they can in reality, especially since they aren’t even enforcing existing regulations and prosecuting the fraud that played a part in the financial crisis.

Why give the federal government more support to create additional regulations when they aren’t even enforcing basic existing ones?

Bruce Smith

Here is an article I’ve found by Richard Werner which summarizes his Credit Creation theory more neatly than I can:-

http://www.diis.dk/graphics/Publications/Andet2009/Should_creation_of_money_stay_in_private_hands.%20Richard%20Werner.pdf

Bruce Smith

I would certainly recommend buying Richard Werner’s book “New Paradigm in Macroeconomics” because it clarifies so many different issues in economics and politics either by direct analysis and solution or stimulation of the reader to do a lot of joined up thinking. The book is like a kind of economic theory detective story but grounded in a real life situation namely the reversal of Japan’s economic fortunes starting in the latter half of the 1980’s. In the process of analyzing why Japan’s previously highly successful economy went off the boil and why different efforts failed to revive it Werner dissects the weaknesses of Neo-classical, Monetarist and Keynesian economic theories and puts forward an economic theory which I will call “Creditism.” This theory is not at all new in its essence. Indeed Werner argues it goes back to Kublai Khan. What Werner does is explain in great deal why it will work so much better in today’s economies by helping to substantially reduce the boom-to-bust economic cycles we have been experiencing with increasing frequency over the last thirty years. He does this by the use of inductive theory derived from analysis of Japanese economic data rather than relying on pure deductive theory which he argues is a common fault of other economic theories. Indeed Werner argues that the Japanese authorities failed to reverse Japan’s economic woes and continue to do so because of this reliance on deductive theories and in particular market fundamentalism or Neo-classical theory.

So what is “Creditism?” It’s simply the theory of Credit Creation. In many ways it’s like magic, the Philosopher’s Stone or the Alchemy of Gold. It’s the ability of banks or government to create credit out of thin air! So, for example, since 2006 in the United States in return for placing 10% by value of any new “thin air” electronically created credit with the Federal Reserve a private bank may provide new “electronic credit money” to the account of a new borrower. The banks can obtain the 10% Federal Reserve deposit not just from fresh customer’s deposits but also from re-payments of compound interest loans, fees, borrowings, investments, re-capitalizations and re-sale of foreclosed assets. Werner then goes on to tell us that if this newly created credit is used to produce GDP goods and services that only involve the transformative use of new resources this “thin air” credit will not be inflationary. However, if it is allocated to non-GDP existing assets, or resources, such as real estate it will be inflationary and will create the boom-to-bust cycles we are currently going through. The solution, therefore, Werner says is to ensure that lending on non-GDP existing resources is carefully controlled by government treasury or finance departments using such devices as minimum deposits or margins and carefully weighted in quantity, or volume ratio, to GDP credit creation. He justifies this latter point on the basis that citizens elect governments to keep the economy socially optimal. In fact Werner goes on to argue that you could in fact pursue the ideas of many anti-Federal Reserve theorists and return the creation of credit responsibility back to government with private banks acting as credit allocators and book-keepers for a fee under strict government guidelines with regard to GDP and non-GDP allocations. Clearly it would be prudent the private banks had some “skin” involved for incentive reasons although Werner points out that private bank allocation of credit would have to be watched because it can be conservative and deter innovation. A good example I think would be in the field of sustainable energy technology where the United States lags behind other countries.

Werner’s “Creditism” arguments lead onto at least two other considerations. Firstly, outside of greed why do private banks engage in inflating existing resources through “pump and dump” credit creation? Secondly, if citizens want a socially optimal economy why do they confuse collective sovereignty with individual sovereignty? I would argue that private capitalism is always under pressure to survive and it survives best by attempting to wipe out its competition through maximizing both size and profitability. A bank will make more profit using credit creation to create bubbles (inflating existing assets) and then, because bubble sizes are limited by loan servicing ability, going short (betting against those loans) just before the bubbles burst. A philosophy of market fundamentalism with selective government support for that philosophy can never, therefore, achieve a socially optimal economy for the bulk of its citizens. If this is the case then citizens logically cannot have it both ways with private capitalism. They cannot enjoy the benefits of innovation and the more accurate matching of demand with supply than state capitalism and still expect it not to free-ride on people and environment because of competitive pressure. If individual sovereignty permits the adverse effects of free-riding market fundamentalism then collective sovereignty expressed through government services, law and enforcement mitigates those effects. The sovereignty argument, therefore, is not either/or as so many Americans polarize it. Werner has now shown us quite clearly by way of new economic theory why we need both.

Finally, I think Werner is cognizant of sustainability issues and this is partly why he set up the Centre for Banking, Finance and Sustainable Development at Southhampton University in the UK. I think he would argue that credit creation will be better controlled through greater emphasis on the process of collective sovereignty rather than continuing with the over-reliance on disruptive individual sovereignty. This would help to ensure that credit creation is used to develop products and services from new resources, or re-directed existing resources, which will be sustainable and particularly the development of sustainable energy technology. Through developing our understanding of “Creditism” I believe Werner is showing a way forward for capitalism to be used in way that allows us as a species to live in greater harmony with the planet we live on.

Albert

Bruce and Mr. Medaille, I thought the Werner essay was very good up to the last two pages. Mr. Medaille’s right that he doesn’t question the fractional reserve and demand deposit system. That seems to be because he relies completely on its money/debt creation to get us out of the recession, eschewing bonds, for example, since they do not create more money. Only, he desires the created money to be spent on the correct investments, investments which are productive rather than non-productive, “productive” being defined as increasing goods and services and “non-productive” defined as consumption and “non-GDP transactions.”

I’m wary of two things: 1) a seemingly uncritical acceptance of the prudence of fractional reserve banking in the society that we have, where the windfall psychology from easy money creation leads to more consumption, apart from enlightened state intervention, and 2) his reliance on GDP as a heuristic for productive industries, and his general working acceptance of all goods/services as inherently productive.

All this is not meant to detract from his helpful descriptive analysis.

What do you guys think?

C. Colwell

Mr. Médaille,

But what if his methods are, more or less, flawless? From our point of view, his methods are flawed because the end result is flawed. It goes against what you would do if you had the best interest of the public in mind. However, what if the end results we are seeing are, in fact, the goal people like Bernake are aiming for?

That is the point. Not that they are idiots or even flawed, but that he and those he coordinates with are executing their program according to plan.

Granted, if you are willing to enter that rabbit hole, it’s quite a dark, dreary, and scary place. However, until we can accurately assign motive and actions to these people, we will never affect any sort of change in the system.

This isn’t about paranoia or conspiracy thinking; it’s taking a pragmatic look at, as I said previously, their actions not their explanations or spin.

What do the actions tell us? They tell us those who control the financial system consistently act like a bunch of oligarchs. The masses are here to serve them. These people do not work for the common good.

Bruce Smith

Here is Bernanke in 2004 equating low inflation to low market volatility which in retrospect seems bizarre although perhaps reflecting the difficulty of policing investment choices on a GDP contributing versus non-GDP contributing basis:-

http://www.federalreserve.gov/boarddocs/speeches/2004/20041008/default.htm

John Médaille

I certainly don’t think Bernanke is an idiot; I do think he operates from flawed premises.

Bruce Smith

If as turkeys we could clearly discern the good and bad in capitalism we wouldn’t be voting for Thanksgiving!

C. Colwell

What’s frustrating to me is when obviously smart and educated folks such all those commenting here seem to miss – IMO – the forest for the trees. You see that these policies are horribly ruinous to us average folks. You see Bernake’s actions, and you see the legislative branch approving his reappointment. You look at all this evidence and you say “these people are idiots” or “they are incompetent”.

Seriously, that’s your answer? They are not idiots and they are not incompetent. Look at the actions, not the press releases. What do their actions consistently tell us?

Why are the results we see almost always the antithesis of what they claim to be their goals?

The answer is as obvious as the forest, but most folks only want to look at the bad tree. It’s as obvious to the nose on your face, but you don’t want to see it.

Bernake, Geithner, Sommers, etc. are not idiots and they are not bumbling fools! I propose that they are probably smarter than the rest of us, and that they are highly successful at what they do.

It is tough, I know. I’ve been there. It’s much easier to think of them as fools than admit it is us ourselves who are the fools. If they are not bumbling idiots, if they are doing what they set out to do, that has some very deep, troubling implications for how our government functions. But don’t let that stop you short of thinking through this.

Look at the evidence. It’s all there right in front of you.

Bruce Smith

One of the things that Werner argues in his book “New Paradigm in Macroeconomics.” is that credit creation constitutes a public goods function and that for banks to create credit for speculative, or “bubble,” activities as opposed to GDP goods and services is not socially optimal. This idea of “public goods function” is clearly something that goes to the roots of understanding human society. According to Werner the deregulating of banks starting under Reagan in the 1980’s released increased competition amongst them so that both the quantity of credit increased whilst the quality of loan determination deteriorated and the ratio between GDP focused credit and bubble credit slanted increasingly in favor of the latter. It becomes possible to argue I think that the reason right-wing Libertarians have no concept of public goods functions is their inability not only to grasp the true dual-nature of human beings but also the repercussions of competition in the Invisible Hand process. So they fail to see that human beings will be driven to free ride by exploiting whatever leverage over others they can achieve and irregardless of the fall-out from these activities. In historical hindsight we will see that these Libertarians made a fetish of freedom over responsibility which in turn made them blind to the whole notion of public goods functions.

John Médaille

You might be right. But Hoover had, I think, decided to abandon the advice of Mellon (“liquidate, labor, farms, businesses”)

Art Deco

Art, I think your numbers are consistent with my account.

No they are not. The economic recovery began in the spring of 1933 and was immediately consequent upon radical changes in monetary policy and the bank holiday. The ratio of federal expenditure to domestic product prior to 1933 was small – about .03 – which limited the capacity of the federal government to stabilize or enhance aggregate demand. Also, Congress at Hoover’s behest increased income taxes in 1932 in an effort to contain the federal deficit. Your contention that the fiscal policies followed by Roosevelt and Congress in 1937/38 wiped out years of rapid economic growth is simply wrong.

Art Deco

I’ve always wondered if that was the reason he was shot.

I do not think there is any evidence Lee Harvey Oswald cared about monetary policy. You have two choices as to why he was shot: a self-aggrandizing exercise on the part of Oswald or a botched attempt at dispatching John Connolly.

Bruce Smith

One other thing that can be said about Werner’s ideas is that he inverts the Agency Theory argument of market fundamentalists. With regard to credit creation instead of “government gone wild” he tells us “Wall Street banks gone wild.” He reminds us:-

“Unless otherwise directed, an institution authorized to create money will maximize its own self-interest in the deployment of that money.”

The knack obviously lies in getting the best accountability society can devise. With Congress having tied itself up in knots and the Supreme Court gone Ape electoral and constitutional reform would also seem in urgent need of action!

Bruce Smith

Yes. I agree that any change in the responsibility for credit creation would have to be accompanied by steps to simultaneously wind-down the adverse effects of trading mercantilism.

Bruce Smith

I think the story behind John Kennedy’s murder linked to his proposed issue of the Silver Certificates is pretty much a conspiracy theory having spent some time reading about it. However, nothing should surprise us when we read about the Mossad killing of the Hamas leader recently and the likelihood that Mossad was behind the Nigerian Yellow Cake uranium letter forgery that was used in part to justify the Iraq invasion by America and Britain. Indeed if the American Revolution was in part prompted by British bankers stopping the Founding State’s governments creating their own credit because Benjamin Franklin naively told them about it then it’s difficult not to be paranoid!

John Médaille

Bruce, that would be true if the “economy” and the “banking system” were the same thing. But they are not. There is no economy to restore. The banks turned to speculation rather than productive lending because there is not enough demand for productive loans. With so many of our goods imported, we cannot supply enough work for our own people. The establishment of a rational banking system has to be accompanied by a re-localization of the economy.

Bruce Smith

When you think about the implication of what Richard Werner is saying the recession could be over in a very short period of time, perhaps six months, given that the politicians were willing to take the power away from the Wall Street banks to initiate credit creation and give it to the government’s Treasury Department or a genuinely independent but politically accountable central bank! This can be done without destroying capitalism and would retain a role for the banks to sensibly allocate capital in the market rather than engage in the high risk gambling they have little aptitude for. This is unlikely to happen, however, because the Republican Party and right-wing Democrats would block any proposed legislation to weaken elite capitalism’s high-roller earning capacity. From reading Werner’s book “New Paradigm in Macroeconomics” and various articles he has written he is well aware that it is simply greed that is preventing a commonsense reduction of the financial crises that occur on a regular basis. He is also very much aware that environmental issues are linked into the “autistic economics” pursued by the right wing Libertarians.

John Médaille

Bruce, That is one of the best short papers on the credit crises I have seen. He does mention the forgotten Executive Order 1101 of John Kennedy; I’ve always wondered if that was the reason he was shot. He does miss the more obvious solution of abolishing fractional reserve banking altogether.

Art, I think your numbers are consistent with my account. The improvement in 1933 has to be credited to Hoover’s policies. The 1938 recession was short because Roosevelt turned the money pump back on, and it has been that way ever since. I also agree about the gold standard. The two countries that did not have it (Spain and China) had no depression, and each country came out of the depression shortly after they abandoned the gold standard.

Bruce Smith

Here’s Richard Werner’s briefly defined take on getting out of a recession:-

http://www.management.soton.ac.uk/research/CBFSD%20Policy%20Debate%20No%201%202009.pdf

Art Deco

The fed tightened the money supply in the depression, but Hoover sought to expand spending; the “new deal” actually began under Hoover. In fact, Roosevelt ran on balancing the budget. And the depression had decisively reversed itself by 1934 (meaning that Hoover’s program was working.) And the economy kept growing until 1937. That’s when Roosevelt decided that the recovery was self-sustaining, and attempted to cut back on spending and balance the budget; he was fulfilling his 1932 promises. The result was that the economy went right back to where it was in 1930.

For the record, the changes in real gross domestic product (when compared to the previous calendar year) were for that period the following:

1930: -8.6

1931: -6.5

1932: -13.1

1933: -1.3

1934: 10.9

1935: 8.9

1936: 13.0

1937 5.1

1938 -3.4

1939 8.1

The year-over-year decline registered in 1937/38 was similar to an ordinary business recession. Real gross domestic product in 1938 was 11% higher than it had been in 1930. Mr. Medaille neglects the wretched banking crisis that hit the United States in November 1932 and came to a halt during Mr. Roosevelt’s bank holiday in March 1933. Some 4,000 banks failed during this crisis, or 22% of the country’s remaining banks. For all that, domestic product in 1933 was only slightly lower than it had been in 1932. Salient factors: the bank holiday, the abandonment of the gold standard, and subsequent reflation.

John Médaille

Hans, a very interesting site. Thanks for the link. Please let me know of any comments you get back on the piece; I would be interested in knowing what the Obama faithful think of it.

Hans Noeldner

Thanks John, you nailed it! In fact I’ve forwarded the link to a number of Grassroots Obama folks who worked their tails off to get him elected. Not to rub their noses in the dirt – I think most of them know by now that Change, it ain’t a-coming.

I think you are missing something about a long-term shift in the economy, however – our problems with “surplus labor” go far beyond outsourcing.

A few centuries ago, most people had jobs and livelihoods associated with real human needs. But during last 200-odd years human sweat has argely been replaced by fossil fuels; human craftsmanship by ever-more powerful and sophisticated machines; and human creativity by the computer. The effect of constantly increasing “labor productivity” is to displace human workers from economic activity that is truly essential for human welfare.

Result: more and more workers depend on luxury consumption, and the only way to prevent unemployment is to constantly increase that consumption. In the end we vacuum ever more credit out of the future to fund present consumption, but it’s a loosing battle.

I invite you to check out “Manufactured Uselessness” at my blog:

http://entropicjournal.blogspot.com/2009/10/manufactured-uselessness.html

Bruce Smith

Other books which provide lengthy arguments for debunking neoclassical economics are “How Markets Fail.” by John Cassidy 2009 and “New Paradign in Macroeconomics.” by Richard A. Werner. In the latter book Richard Werner also makes the argument based on Japan’s Lost Decade that it is credit creation and not the interest rate level which should be used as the primary tool for getting an economy out of a recession. The alternative to neoclassical theories or rather the adaption seems to have currently acquired the title of Real-World Economics after starting out in France with the pejorative title of Post-Autistic Economics although the network of economists pursuing these theories still use the Post-Autistic title. Here is the orginal Post-Autistic web site with link to Real-World Economics Review web site:-

http://www.paecon.net/

John Médaille

Christopher, I have just finished reading Keen’s Debunking Economics which is an attack on the formal and mathematical roots of neoclassical theory. I didn’t agree with all of it, but it is still very good. It is available as an ebook for $10 at http://www.debunkingeconomics.com/

Bernanke’s plan “worked” by restoring the status quo ante. The big banks are now bigger, and their profits come from the same financial speculation that got us here.

Unfortunately, thinking about the Great Depression is guided by Friedman’s history, which totally misunderstands the situation, both then and now.

Christopher Harrison

Ben Bernanke has remained clueless on handling the current recession. He is often given platitudes in conventional (neoclassical) economics circles, but alternative viewpoints also highlight how little he actually understands about why the Great Depression happened, in spite of his voluminous writing on the topic.

Australian economist Steve Keen, a follower of Hyman Minsky’s Financial-Instability Hypothesis, called out Bernanke’s cluelessness here: http://www.debtdeflation.com/blogs/2010/01/24/debtwatch-no-42-the-economic-case-against-bernanke/.

Bernanke’s “solutions” may be working in the short term, but the existence of free money encouraging further speculation by big banks is hardly encouraging a return of any stability to the system. In short, he can’t solve any of the financial problems we face because he doesn’t even know what the real problems are.

D.W. Sabin

All one really needs to know about the general prognosis is summed up by the events of this last January 21 when Copake, N.Y. Farmer Mr. Dean Pierson methodically shot his 51 cows in the dairy barn before convening to his house in order to sit down and shoot himself. He was 59 and had callouses. The scene in the barn, Mr. Pierson at wits end with these cows dropping on the cement, one after another, the gore draining into the sidewall troughs is almost too horrible to ponder.

He left a note on the door , warning whoever came by not to go inside and just call the police.

He was reported to have been experiencing “personal problems”. His neighboring farmers remain tight-lipped beyond asserting that “these are hard times to be a farmer”. They are not alone…unless, of course, they are being bailed out, are in the security business or sell war material.

Paul Craig Roberts is likely underestimating the fact that the citizen has yet to be milked hard by our big strapping institutions. They will not likely see the gun coming either.

Its ok though, all we need is some leadership. Needless to say there has been little said nor noted about the stark insanity of an American Farmer shooting 51 cows in the cold winter night of his all-too typical discontent. We would rather watch something with a happy ending or do nothing in the face of a continuing farrago in the seat of “OUR” government.

Siarlys Jenkins

Secrets of the Temple sounds good. I’ll keep my eye out for it. My local public library is weeding out books nobody has been reading, which includes some of the best unfortunately, and they will end up at a little bookstore and cafe down the hall from the main entrance. I don’t share your faith in Herbert Hoover, although he was in some ways a decent man (not so good on going for the southern white dry anti-Catholic vote by dumping the Republicans’ traditional black constituency). We could however take a lesson from the failure of Roosevelt’s attempt to balance the budget in 1938, and the resulting renewal of Depression: it is a strong warning about what would happen if the Republicans got to enact their sudden rhetorical commitment to repeat Roosevelt’s error.

John Médaille

The fed tightened the money supply in the depression, but Hoover sought to expand spending; the “new deal” actually began under Hoover. In fact, Roosevelt ran on balancing the budget. And the depression had decisively reversed itself by 1934 (meaning that Hoover’s program was working.) And the economy kept growing until 1937. That’s when Roosevelt decided that the recovery was self-sustaining, and attempted to cut back on spending and balance the budget; he was fulfilling his 1932 promises. The result was that the economy went right back to where it was in 1930.

It was another example of the fiscal policy running one direction and the monetary policy running the opposite way. Bernanke’s monetarism has failed; he has flooded the banks with liquidity, but the banks are still not lending. He fundamentally misunderstands the problem.

I hope you are right about Obama, but I don’t think it matters, because he has no power. Like all the Democrats, he’s brought a knife to a gun fight. Make that a water pistol. And there are forces beyond his control.

The book you should get (and it should be cheap in the used book stores) is William Grieder’s “The Secrets of the Temple.”

Siarlys Jenkins

You are a sensible man, but this is a little shallow. Here is my take on Bernanke. He was appointed by George W. Bush. He was sold on the Republican orthodoxy that if we repeal all the controls imposed on the banks during the New Deal, just sit back and enjoy the ride, prosperity will go on forever. When the crash came, he was asleep at the wheel. Nevertheless, we are lucky that he was in charge of the Fed. Why? He is the nation’s most practical expert on the Great Depression. He knew what had to be done in the crisis that should never have happened, and he made the right moves.

We all make judgements like that based on what we’ve read, who we talk to, what our personal experience is, who we trust, what clicks in our own unique little minds. I’ve done some reading on the Depression. There is a good book out I have to get hold of and read all the way through when the price drops enough that I can afford it, or I find a better income stream. It basically laid out that a very small clique of financiers manipulating money for immediate profit plunged the entire nation into thirty percent unemployment. Everything Roosevelt tried didn’t work, and the ultimate cure was wartime production, but one thing that made it worse was poor clueless well-intentioned Herbert Hoover tightening the money supply and trying to balance the budget. Bernanke made the right moves.

I do have one expert to rely on. My mother is a lifelong Republican, a fiscal conservative, who lived through the last Depression. She had a better sense than most that we really were on the edge of another one. She’s also deeply embarrassed that of the last three Republican presidents, two of them ran our deficits sky-high while smiling gamely about “tax cuts” that were not paid for, and it was mostly on the Democrats’ watch we started to pay the debt down for the first time in my lifetime.

Obama put far too much faith in his own party, but I think there is a lot more life in him than you observe. It was a mistake to put “Obama for America” under the DNC once he got the nomination. I haven’t donated since he did. Roosevelt didn’t manage to replace worn-out Democrats with New Deal stalwarts in 1938, and I doubt if Obama can pull that off in 2010 — although it would be a good idea. Its going to be a rocky year, but I shudder to think what a mess we would be in if John McCain were president, or even Mitt Romney, who isn’t half the man his father was. (I’m old enough to remember the difference).

Robert

I am glad to know I am not the only reader of Paul Craig Roberts.

Bruce Smith

Hmmm…..a lame duck President for the next three years, that should bring on the next financial crash sooner than we thought.

HappyAcres

If you accept that the State is a gang of inept criminals, your frustration and confusion will go away.

Of course the Fed debases granny’s money.

Of course corporations want influence with imperial masters.

Hell, I want influence with my imperial masters.

Comments are closed.