Washington DC

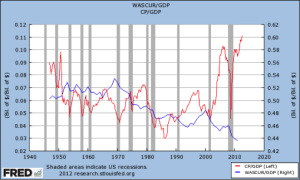

When President Obama took office in 2009, many friends of capitalism were concerned that he would socialize our economy. Yet corporate profits have hit record heights during his presidency. For example, one report argues that the profit growth rate under Obama is far any away the most significant of any administration since 1900, outpacing second-place Harding by a factor of five. Bloomberg reports that after-tax corporate profits have increased by 171% since Obama took office twice as high as they were during their peak under Reagan. (Note: if you use January 2008 instead of January 2009 as the starting point the numbers change dramatically.)

Part of the record profits stems from the fact that wages have hit a 70-year low.

While the majority of new jobs pay low wages, workers in established jobs have seen a flatlining of their wages. Worker incomes are now $3,850 a year lower than they were when Obama took office. Median wages for men between the ages of 19 and 64 dropped 19% between 1971 and 2011.

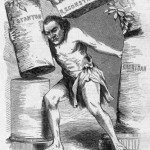

The persistence of claims that Obama is a socialist receives an interesting rebuttal from this article, which argues that Obama is a capitalist of a different stripe. Rather than favoring the old productive economy, where wealth is drawn from the soil and manufacturing – the economy of banks, corporations, energy companies, and agribusiness – Obama has shifted economic support to the professional and technical classes. This would explain the massive financial and electoral support he received from entertainment moguls, people in the news media, the tech and computer sector, academics, and government workers. This new class, Kotkin argues, forms a clerisy more interested in shaping opinion than in wielding economic power. They believe in elite rule and using social institutions and media to buttress that rule. And it also helps to explain the contentious nature of our politics. Says Kotkin:

“More disturbing still may be the clerisy’s regal disregard for democratic give and take. Both traditional hierarchies, or new ones like the Bolsheviks after the 1917 revolution, disdain popular will as intrinsically lacking in scientific judgment and societal wisdom. Some leading figures in the clerisy, such as former Obama budget advisor Peter Orszag, openly argue for shifting power from naturally contentious elected bodies to credentialed “experts” operating in places Washington, Brussels or the United Nations.”

Kotkin’s essay is an interesting one, but he seems to misunderstand the persistent power of our largest banks. A fascinating report recently released by the Dallas Fed demonstrates the continued persistent effects of the Too Big to Fail program. According to the author, community banks consistently deliver superior performance, and the reason for this is they are more easily regulated and are subjected to the market disciplines of bankruptcy and failure. They don’t take stupid risks because they can’t afford to. While 98.6% of all banks are community banks, they only hold 12% of all commercial banking assets. Meanwhile, 69% of all commercial banking assets are held by the largest banks, which comprise 0.2% of all banks.

Regulation has skewed the playing field even more in the favor of the five largest banks. The complex regulations of the Dodd-Frank reforms have placed tremendous burdens on the smaller banks that weren’t part of the problem to begin with. In order for Dodd-Frank to be properly enacted over two-and-a-quarter million labor hours a year would be required to insure compliance. In the meantime, the largest banks have received significant financial benefits resulting from an artificial uplifting of their credit rating from unsecured creditors.

Indeed, the Washington Post reports that the five largest banks are now making big money on mortgages, particularly refinances. JP Morgan Chase reported $418 billion in profits from the mortgage business in the 2012 calendar year. A good deal of the profits enjoyed by these banks result from the President’s Home Affordable Refinance Program.

None of this should be surprising given the revolving door that has existed between Wall Street and Obama’s White House. Jacob Lew, the Treasury Secretary designate, oversaw the $45 billion Citigroup bailout, where he was the Chief Operating Officer in the “alternative investments unit.” He got paid handsomely for his trouble, to the tune of over $2 million a year. In the meantime, of course, the Obama administration continues every month to purchase $40 billion in mortgage-backed bonds from the largest banks.

On the other side of the scale, small businesses and financial institutions must face the squeeze put on them by excessive regulation, burdensome taxes, and the impending costs of the Affordable Care Act. For reasons I’ll go into in my next post, the government has done a poor job calculating the total costs of the ACA.

While nothing suggests Obama is a socialist, those of us who have read our Marx may see in him features of late capitalism: concentration of wealth, cooperation between the state and owners, greater wealth inequality. The American worker may not have experienced the sort of immiseration Marx predicted for him, but things don’t seem to be getting any better. More than ever, as the report of the Dallas Fed reminds us, the questions of politics and economics are fundamentally questions about size, scope, and scale. Sadly, neither of our two major parties get this. Next week I’ll be giving further evidence of this as we consider the debt ceiling problem.

13 comments

Perceval

Kpres: I think you will find that low wages are anything but “BS” to those who struggle to earn and live on them. D

lliamander

Rob G.,

your point about us and China heading for the same place from opposite direction is something I’ve observed for many years now, I’m glad to see someone else has come to the same conclusion!

KPres,

Rob G.,

your point about us and China heading for the same place from opposite direction is something I’ve observed for many years now, I’m glad to see someone else has come to the same conclusion!

KPres,

I’m glad you can clip your own charts too, but as the saying goes, “there’s lies, damned lies, and then there’s statistics”. Now I’m not saying your interpretation of the statistics is wrong per se, but I do have a number of misgivings. First, what kind of benefits are we talking about? Things like health insurance? Is the amount of health insurance benefit growing faster than the rate health care costs? Of course, health care is getting better, so if the health care costs are rising faster than the rate of insurance benefits, we might attribute that to higher quality. But of course, technology and commoditization of health care services and equipment should be driving down health care costs. Basically, I’m asking whether or not the increased compensation (in terms of real dollars) are keeping up with costs of living (i.e. profit on an individual scale). Second, do you know the societal impact of favoring benefits over wages? I don’t have any research on this, but I think its a reasonable hypothesis that favoring benefits over wages is keeping people from rising the economic ladder, because people don’t have as much “liquidity” with which to purchase capital assets (stocks, real estate, etc.). The benefits, since they only extend for the term of the employment, increase the dependency of the employee on their employer, and make it more difficult for them to go out on their own. Of course, I’m assuming here that the benefits are primarily insurance, which is only useful for mitigating the risks of catastrophic emergencies or developing chronic illnesses and not directly useful the gaining of wealth. Now, if the benefits were talking about include things like sick leave and vacation time, well, that changes things somewhat, since more free time means more opportunity to make money, but in actuality people tend to incur greater costs with those leaves of absence (trips, eating out, gambling, etc.) and tend to avoid any money making activities. Furthermore, I have a (unscientific) feeling that overtime rates have probably gone up as well (this gets complicated when you start to look into pre-WWII America, given that the work weeks were longer). Then there’s benefits like stock options and 401k. Of the two, I’d say 401k is probably the only one that is a reasonably sure benefit (i.e. investing in a single company is a lot riskier than investing broadly). All this said, I doubt the increasing benefits is really helping people build wealth as fast as an increase in wages would.

Now, in line with what you stated regarding corporations, we can’t just look at individual profit, we have to look at individual profit margin. Then, we might actually have a sense for how people are doing. Now, I’m going to go down a slight tangent regarding corporate profit margins. You say that profit margins are roughly the same as they were in the post-WWII boom. You seem to be under the impression that the original author was stating that high corporate profits (or corporate profit margins) is a sign of late-stage capitalism. I say that because my impression of the comparison with the post-WWII boom you used as your counter-argument was that, since corporate profit margins are the same now as then, and since then was clearly not late-capitalism (so you think) that clearly we are not in late capitalism now. I think such a line of reasoning is fallacious, because, among other things, it doesn’t factor in personal profit margin. I think a good definition of late stage capitalism (or corporatism) might be when there is a sustained period of high corporate profit margin and low personal profit margin. I don’t have hard data to back this up, but I think it’s a fair judgment to say that during the post-WWII boom personal and corporate profit margins are up, whereas today there is a significant disparity. If we can attribute this state of affairs to our current President’s tenure, than I do think the author’s point is still valid.

I invite you to respond, and perhaps you can help fill in some of my gaps in understanding with valid research, but since you’ve demonstrated a lack of cognitive endurance and charity in responding to the original author, I won’t hold my breath.

Jeffrey Polet,

Sorry for the long winded comment, but I just wanted to say that I totally appreciate where you’re coming from. As a technology professional, I can tell you that this unfortunate bond exists between our current administration and the majority of my peers; the rest of us largely being some form of Libertarian (see schneier.com) or Carlyle-esque reactionary (see unqualified-reservations.blogspot.com). I can only say that, as for myself, I got into the industry because a) I like the kind of intellectual effort it involves and b) It’s one of the few industries in which labor has such leverage over capital, and in which an individual can be an autonomous artisan (i.e. freelancer) as opposed to a grunt employee. As to whether a software developer like myself counts as a “producer” or “service provider”, I would say that the question is non-trivial (and indeed has significant legal ramifications).

D.W. Sabin

Thanks KPres,

Glad to hear some folks still get “Benefit Packages”. I do miss Disco.

KPres

Good lord not the “wages” BS again.

First off, “wages” are irrelevant since the tax code was altered to incentivize compensation in the form of benefit packages rather than cash. Total compensation (wages+benefits) per hour has been growing at essentially the same rate that it always has (going back to 1860, btw).

Secondly, why did you post GROSS corporate profits instead of profit MARGINS? Oh, because that wouldn’t present the dramatic rise you want people to believe has happened. Corporate profits MARGINS have risen over the past 20 years, but not anything out of the ordinary…they’re about as high as they were during the Post-War Boom. I guess that was “late capitalism” too.

Whatever else you wrote here is likely garbage, but I stopped reading after I saw your manipulative little chart. Why should I care what else you have to say when you start your first paragraph with a lie?

COMPENSATION Per Hour:

http://1.bp.blogspot.com/-b04y8q5Wbfo/TqS40zf1JfI/AAAAAAAAP6Q/qWwIpezY_aY/s1600/realcomp.jpg

Corporate Profit MARGINS:

http://seekingalpha.com/article/313032-stock-outlook-the-problem-with-peak-profit-margins

D.W. Sabin

Both political factions have accrued a bill that would normally crash any weak society.This unfortunate obligation is doing its best to sink us, aided by a banking edifice that is self-destructively and willfully self-absorbed. The daft “service economy”, based upon leverage and exported labor has systematically gutted the component of this society which once imparted its greatest riches. President Obama is just another un-indicted co-conspirator in this long process of global ebbs and flow.

Fortunately for us, the Chinese, habitual suckers for the charms of oligarchy, are on an accelerated course of dismissing the realities which confront them.

Unfortunately, we still think we’re fine. When a nation begins to crow about its “indispensability”, you know that it likely threw what it once dispensed over board some time ago.

Rob G

Oops…”he fits the bill for neither…”

Rob G

I’ve felt all along that the Dear Leader was a species of socialist, albeit not a doctrinaire, card-carrying one, but moreso than that he’s a cultural Marxist, or what I believe Paul Gottfried calls a post-Marxist. The problem with calling B.O. a socialist is that he doesn’t fit the bill for neither the doctrinaire type nor the perception the common person has about what one is.

From the opposite side our “state capitalism” could very easily be called “corporate socialism.” Seems to me we are heading for the same place China is heading, but from the opposite direction.

Matt

This idea of appointing the experts rather than voting is one that is rapidly gaining ground on the left. Their logic is airtight: we know what should be done, we know who knows what should be done, if we put it to a vote then the retrograde elements of the population will have a chance to derail the plan. This is why I think the left will have totally abandoned democracy by 2050 as a way to govern society.

Brian

Surely some mention of distributism is appropriate here. Chesterton & Belloc would be not a bit surprised by recent (i.e., the last few decades) economic events. Whether they’d call Obama a late-stage capitalist or a socialist trying to achieve the bridge from capitalism to outright socialism (i.e., his & others previously stated end goal of a “single payer” health system) I don’t know, but arguing over silly semantics like this is pointless. The path we’re on is still crystal clear, and one that clear thinkers have foreseen for over a century.

John Gorentz

It should also be pointed out that socialists and socialism don’t have a lot in common. Similarly, socialist policies and socialist results are two different things.

robert m. peters

Marx considered capitalism in its most virulent form, namely corporatism, to be the stalking horse for socialism in that the apparent owners of a corporation are the stock holders while the effective owners are the boards boards and upper management. In the socialist fiction, the “people,” what ever that entity of myth or fiction might be, own the government; but the effective owners are the ideologues, pedants and bureaucrats of the cadre. Allen Tate calls this to mind in his article in the book “Who Owns America,” the sequel to “I’ll Take My Stand.”

By analogy, capitalist corporatism with its government assisted cheap money and consumerism, both placating our collective inability to postpone gratification, are the Panzer divisions; socialism is the systematic mop up by the Einsatzgruppen.

Michael Umphrey

He remains an ideologue–operating with a system of theories created and favored by an intellectual class that will take care of itself while projecting to those outside the inner party mind-numbing platitudes tending toward liberty, fraternity and equality.

John Gorentz

Under Obama’s policies the rich are getting richer, the poor poorer, and the middle class is disappearing. So how can he not be a socialist?

Comments are closed.